Market orders and limit orders allow you to open positions when trading crypto under certain specific conditions. More specifically, they allow you to either open a position immediately — as with a market order — or at a specific desired price — as with a limit order. As such, these two order types are essential for beginner traders to understand.

In this article, we'll help you to understand what a market order and limit order are, the pros and cons of each, and when to apply them.

TL;DR

Market orders and limit orders are used to open positions when trading crypto. They determine when a position is opened and at what price, depending on which you choose.

Market orders allow you to open a crypto position immediately at the current market price. Limit orders, meanwhile, allow you to open a position only when a specific price — set by you — is reached.

Market orders are sometimes preferred by traders who are looking to enter the market immediately, and hold their position across a long time horizon. Limit orders, meanwhile, typically provide traders with greater price control.

To determine which order type is right for you, it's important to first understand the differences between market orders and limit orders, before scrutinizing each option in the context of your personal preferences and priorities.

Market orders

What are market orders?

A market order is an order to buy or sell a cryptocurrency at the best available price in the current market. Essentially, it allows you to buy or sell a cryptocurrency as soon as possible, regardless of the price.

Market orders are usually executed almost immediately and are ideal for traders who want to buy or sell a cryptocurrency as quickly as possible. When executing a market order, you’re considered a market "taker" and your order is subject to taker fees.

Market order example

If the current market price is $100, a buy or sell market order will be filled at around $100.

Market order advantages

Immediacy: Allow trades to be executed immediately so you can enter the market without delay

Likelihood: Because positions are opened at the current market price, it's highly likely (but not guaranteed) that your position will be executed.

Simplicity: Market orders are generally simpler to place when compared to limit orders, because you don't need to determine and set the specific price to open a position at.

Market order disadvantages

Slippage: Slippage may be encountered, where the price at execution differs from the price you expected. High slippage is typically seen during periods of high volatility, where prices can rise and fall quickly.

Lack of control: You have less control over the price you'll receive when placing a market order because crypto prices are always fluctuating.

Potential higher fees: Crypto exchanges sometimes charge higher fees for market orders because you're considered a taker when opening this type of position, and are therefore removing liquidity from the market.

Limit orders

What are limit orders?

A limit order is an order to buy or sell a cryptocurrency at a specific price or better. Unlike market orders, limit orders allow you to specify the exact price at which you want to buy or sell a cryptocurrency.

Limit orders are ideal for traders who want more control over their trades and are willing to wait for the right price. When executing a limit order, you’re generally considered a market 'maker' and your order is subject to maker fees.

However, there are scenarios where a limit order is considered a taker order, such as when the limit order is executed immediately.

Limit order examples

Buy order

If the current market price is $100, a buy limit order priced at $80 will only be executed when the market price drops to $80 or below.

Sell order

If the current market price is $100, a sell limit order priced at $120 will only be executed when the market price rises to $120 or above.

What are advanced limit orders?

An advanced limit order is a type of limit order that includes additional conditions. Advanced limit orders could be 'post only', 'fill or kill', or 'immediate or cancel'.

Post only

Post only limit orders are executed only if they don't immediately match with existing orders in the market. They add liquidity to the market, and the user becomes the market maker.Example: If the current market price is $100, a post only buy order priced at $90 will enter the order book. When a post only buy order priced at $110 matches with an existing order, the order will be canceled.

If the current market price is $100, a post only sell order priced at $110 will enter the order book. When a post only sell order priced at $90 matches with an existing order, the order will be canceled.

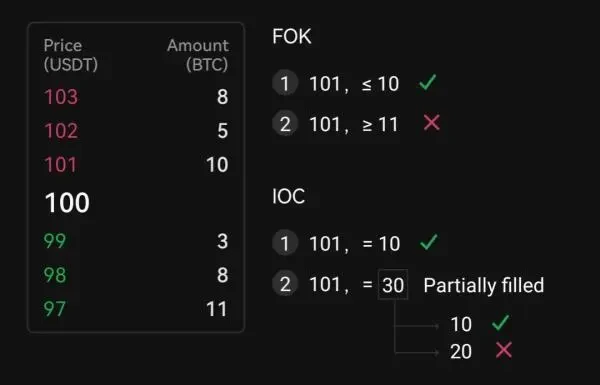

Fill or kill (FOK) and immediate or cancel (IOC)

A fill or kill order requires the entire order to be executed immediately, or it will be canceled. For immediate or cancel orders, it must be executed immediately, and any unfilled portion of the order will be canceled.

For example, let's imagine the current market price is $100, and lowest priced sell order is $101 with 10 quantity. A fill or kill buy order priced at $101 with 10 or fewer quantity will be filled. But, if the fill or kill buy order has 11 or more quantity, it will be canceled.

Meanwhile, an immediate or cancel buy order priced at $101 with 10 quantity will be filled immediately. However, an immediate or cancel buy order priced at $101 with 30 quantity will be partially filled at 10 quantity, and the remaining 20 quantity will be canceled.

Limit order advantages

Greater price control: By determining the specific price at execution, you gain more control over your trade, compared to market orders.

Reduced exposure to volatility: By specifying the price at which you want your order to be executed, you can minimize exposure to market volatility. If prices move against your expectations, you could potentially avoid a loss.

Strategic precision: With the ability to set the desired price of execution, you gain greater precision from your strategy, which could lead to more favorable results. Limit orders can be placed where you calculate support or resistance levels to be, for example, increasing your chances of success.

Limit order disadvantages

Missed opportunities: Using a limit order places some of your funds on the sidelines until prices reach a certain level. As a result, you're potentially missing out on opportunities for successful trades, which could have been taken had you been more proactive.

Complexity: Limit orders are considered more complicated than market orders because they require you to decide a price to enter a trade at. Deciding the specific execution price requires careful consideration and the completion of technical analysis, which not all beginner traders may be confident in.

Non-execution: It's possible your limit order won't be fulfilled if prices don't move in the direction you expect. That's another missed opportunity to make a successful trade, limiting the effectiveness of your strategy.

When to choose a market order and limit order

Choosing between a market order or a limit order when trading crypto should start by understanding your preferences and the current market dynamics.

If the market is highly volatile and showing large price swings, it may be wise to choose a limit order. Doing so will allow you to execute positions only when prices reach a level you're comfortable with. In this scenario, with a market order, prices could suddenly move against you just as the trade is executed, limiting your success.

If you're looking to open a position and hold it for a long time period, a market order could be considered preferable. Here, time in the market is the priority, and so you might want to execute as soon as possible, which a market order allows. Even if prices do move against you on execution and slippage is encountered, the loss could be minimized in the future if prices have recovered when the trade is closed.

The final word

Market orders and limit orders are a fundamental part of effective crypto trading, and an essential tactic for beginner traders to get to grips with. By understanding each order type as well as how to apply them most effectively, you can get more value out of your trading strategy and potentially achieve better results.

FAQs

A market order instructs your trading platform to open a buy or sell position at the current market price. Meanwhile, a limit order instructs the platform to only open the position once a specific price, set by you, is met.

"Better" is subjective, and each order type offers its own advantages and disadvantages. It's important to understand these pros and cons before you begin to trade, so you can decide which is best suited to the current market circumstances, and your personal strategy and risk profile.

No order is riskier than the other. Although market orders can cause you to be exposed to high slippage during periods of volatility, there are also risks to consider from limit orders, such as the risk of lost opportunity and the complexity of deciding a limit order price. It's essential to do your own research on each order type before you commit time and money to a trade.

First, it's imperative to understand the differences and the advantages and disadvantages of each order type. Next, consider your personal preferences and priorities to see which order type is best suited to you. Whichever choice you make, it's wise to make sure you only trade with funds you're comfortable losing, and apply fundamental risk management tactics such as the use of a stop-loss.

© 2025 OKX。本文可以全文复制或分发,也可以使用本文 100 字或更少的摘录,前提是此类使用是非商业性的。整篇文章的任何复制或分发亦必须突出说明:“本文版权所有 © 2025 OKX,经许可使用。”允许的摘录必须引用文章名称并包含出处,例如“文章名称,[作者姓名 (如适用)],© 2025 OKX”。不允许对本文进行衍生作品或其他用途。