As a crypto bull run might be in play in 2024, it's a good time to explain what crypto bull markets are and how to identify them. A bull market occurs when prices of assets, such as stocks, bonds, or cryptocurrencies, are on the rise and confidence among traders is high. In a bull market, the trend is generally upward, with buying activity dominating selling activity. This results in increased demand and a general feeling of optimism in the market. Bull markets are usually accompanied by economic growth and strong market performance. This guide discusses crypto bull markets, their significance, and how beginners can understand and benefit from them.

Understanding cryptocurrencies

Before proceeding, it's important to first grasp what cryptocurrencies are. In short, cryptocurrencies are digital assets designed to work as a medium of exchange, just like traditional currencies such as the US dollar or Euro. However, unlike traditional currencies, cryptocurrencies are decentralized and operate on a peer-to-peer network, without the need for intermediaries such as banks.

Types of cryptocurrencies

Bitcoin (BTC): the first and most popular cryptocurrency, Bitcoin operates on a decentralized network called the blockchain and is designed to be a store of value and a medium of exchange.

Ether (ETH): Ethereum is a decentralized platform that allows for the creation of smart contracts and decentralized applications (DApps). Ethereum's native cryptocurrency is Ether (ETH).

Ripple (XRP): a cryptocurrency designed for the global payment and remittance industry, Ripple aims to facilitate fast, secure, and low-cost transactions.

Litecoin (LTC): a cryptocurrency designed to complement Bitcoin, Litecoin is often referred to as the "silver to Bitcoin's gold".

Solana (SOL): Solana is a layer-1 blockchain platform that aims to provide high-performance, scalability, and security.

How are cryptocurrencies created?

Cryptocurrencies are created through a process called mining, which involves solving complex mathematical equations on the blockchain network. This process verifies transactions and adds new blocks to the blockchain. In some cases, new coins are also created as a reward for mining activity.

How are cryptocurrencies traded?

Cryptocurrencies are traded on exchanges. Transactions on cryptocurrency exchanges are recorded on the blockchain and are irreversible. Additionally, cryptocurrencies can be stored in digital wallets, which are secure online or offline storage solutions. Transactions between wallets are also recorded on the blockchain.

Cryptocurrency trading involves significant risks and can be highly speculative. The crypto market is highly volatile and prices can fluctuate rapidly in response to market developments and news events. Therefore, crypto traders should always do their research, seek professional advice, and only trade what they can afford to lose. What's more, crypto traders should take steps to secure their digital wallets and protect their holdings from potential cyber-attacks and fraud.

Factors that drive crypto bull markets

Several factors can drive crypto bull markets. Here are some of the most important ones:

Market demand and supply: as with any asset, the laws of supply and demand play a crucial role in determining the price of cryptocurrencies. If there's high demand for a particular cryptocurrency and the supply is limited, its price will likely rise.

Media coverage and hype: media coverage can significantly impact the public's perception of cryptocurrencies. Positive news coverage or celebrity endorsements can create a hype cycle, driving up demand and prices.

Regulations and government actions: government regulations and actions can significantly impact the crypto market. Positive regulatory developments, such as approving Bitcoin ETFs or legalizing cryptocurrencies in a particular country, can increase demand and prices.

Technology advancements: Advances in the underlying technology of cryptocurrencies can also stimulate bull markets. For example, launching new blockchain platforms or developing more efficient mining algorithms can create excitement and drive up prices.

These factors can also work in the opposite direction, leading to bear markets and declining prices. This is why it’s imperative traders stay informed, and keeping track of developments in the crypto market is essential to identify potential opportunities and risks.

Historical examples of crypto bull markets

Crypto bull markets aren't a new phenomenon. Here are some historical examples of notable bull markets that occurred in the cryptocurrency industry:

Bitcoin in 2013-2014

This was the first major bull market for Bitcoin. Its price rose from around $13 in January 2013 to over $1,100 in December 2013. The bull market was largely driven by increased media coverage and hype around Bitcoin and positive developments in the industry, such as the launch of new exchanges.

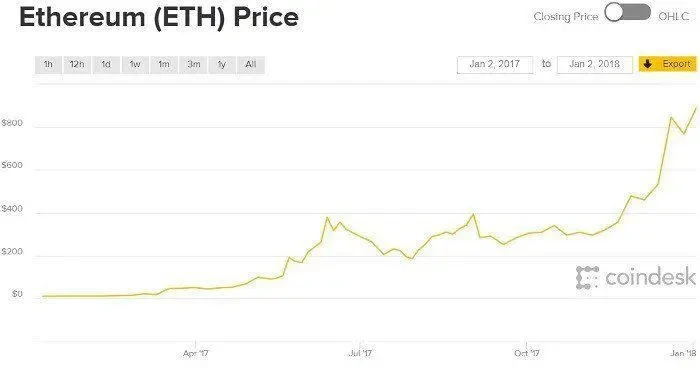

Ethereum in 2017

In 2017, the price of Ethereum skyrocketed from around $10 in January to a peak of over $1,400 in December. The bull market was largely driven by the launch of new blockchain applications and ICOs (Initial Coin Offerings) built on the Ethereum platform, as well as media coverage and hype around the technology.

Bitcoin in 2020-2021

The most recent bull market for Bitcoin began in late 2020 and continued into early 2021, with the price of Bitcoin reaching an all-time high of over $69,000 in November 2021. This bull market was largely driven by increased institutional adoption of Bitcoin, alongside a growing broader awareness and acceptance of cryptocurrencies.

While these bull markets offered significant opportunities for portfolio gains, they were also accompanied by significant risks and volatility. Cryptocurrencies are a highly speculative and volatile asset class. As a result, crypto traders should approach them with caution and a long-term perspective.

The 2023-2024 bull run

Hot on the heels of the FTX collapse and reported year-on-year Consumer Price Index numbers of 7.1% in November 2022, many believed 2023 would be the year that breaks crypto's back, given the sheer number of collapses and no end in sight for rising inflation numbers. Yet, Bitcoin proved many critics wrong as 2023 proved to be the year of recovery for the crypto markets. With a 155.57% annual return, BTC prices surged to $42,283 and closed the year on a high thanks to the rise in interest in spot Bitcoin ETFs and talks of Fed interest rate cuts on the horizon as inflation is finally deemed in control.

Bitcoin then proceeded to start the year strong in 2024 despite fears of ETF outflows from Grayscale Bitcoin Trust ETF threatening a BTC price collapse post-spot ETF approval. With Bitcoin prices close to all-time highs, crypto traders can't help but educate themselves on how to trade Bitcoin and speculate about the new highs that BTC might achieve with the Bitcoin halving happening later this year.

How to identify a crypto bull market

Identifying a bull market can be challenging. However, several indicators and market strategies can help. Here are some ways to identify a potential bull market in the crypto industry.

Market indicators to look out for

One of the best ways to identify a crypto bull market is by analyzing market indicators such as price trends, trading volume, and market cap. If these indicators are all trending upward, it could be a sign of an impending crypto bull market.

Technical analysis

Technical analysis is a popular trading strategy used by traders to analyze price trends, and make trading decisions. Traders can identify potential entry and exit points during a bull market by analyzing chart patterns, support and resistance levels, and other technical indicators.

Keeping up with news and trends

Staying informed about industry developments, regulatory changes, and the latest technological advancements can help crypto traders to identify potential trading opportunities and risks in the crypto market.

While these strategies can be useful in identifying potential bull markets, there's no guarantee of success. Cryptocurrencies are highly volatile and can have rapid price fluctuations, even during a bull market. As a result, crypto traders should approach any crypto trading activities with caution and clear risk management.

Strategies for trading in a crypto bull market

Trading in a crypto bull market can be highly lucrative, but it's important to approach it with the right market strategies and mindset. Here are some tips for trading in a crypto bull market:

Diversification

Trading various cryptocurrencies can help spread risk and reduce the impact of market fluctuations. It's important to do your research and trade projects with strong fundamentals and long-term potential.

Dollar-cost averaging (DCA)

The DCA strategy involves alloting a fixed amount of money at regular intervals to trade for the long-term, rather than trading a lump sum all at once for the short-term. This can help to reduce the impact of market volatility and smooth out returns over time.

Long-term holding

Cryptocurrencies can be highly volatile in the short term, but they can also potentially deliver significant returns over the long term. Holding your crypto portfolio over a longer period can help to ride out market fluctuations and benefit from the industry's overall growth.

Risk management

It's important to approach any long-term cryptocurrency positions with caution and patience. This means setting realistic expectations, diversifying your portfolio, and using risk management strategies such as stop-loss orders to limit potential losses.

Note that trading in cryptocurrencies is highly speculative and involves significant risks. Crypto traders should always do their own research, seek professional advice, and only trade what they can afford to lose.

Risks associated with crypto bull markets

While crypto bull markets offer significant opportunities for gains, they're also accompanied by significant risks. Here are some of the risks associated with trading during a crypto bull market:

Market volatility

Cryptocurrencies are highly volatile and can experience rapid price fluctuations, even during a bull market. This can make time entry and exit points difficult and result in significant losses.

Scams and fraud

The crypto industry is still largely unregulated, which can make it a breeding ground for scams and fraud. Crypto traders should always do their own research and be wary of any trading opportunities that seem too good to be true.

Lack of regulations and protections

Unlike traditional investments such as stocks and bonds, cryptocurrencies aren't regulated by the government. This means individual protection for crypto traders is relatively low, which causes them to be more vulnerable to fraudulent activities.

Cybersecurity risks

Cryptocurrencies are stored in digital wallets, which can be vulnerable to cyber-attacks and hacking attempts. Crypto traders should always use secure wallets and take steps to protect their crypto holdings.

It's important to approach any trading activity with caution and a long-term perspective. Traders should always do their own research, seek professional advice, and only trade what they can afford to lose.

The final word

Crypto bull markets offer significant opportunities for portfolio growth, but significant risks also remain. As a result, crypto traders should approach any trades with caution. Completing thorough research and due diligence is fundamental, and it's also wise to seek professional advice and only trade what you can afford to lose. Diversification, dollar-cost averaging, long-term holding, and risk management are all important market strategies for trading a crypto bull market.

While cryptocurrencies are a relatively new asset class, they're quickly gaining mainstream acceptance and adoption. As the crypto industry continues to grow and evolve, crypto traders can expect to see both opportunities and risks associated with this emerging asset class.

Frequently asked questions

How long does a bull run last in crypto markets?

The duration of a bull run in crypto can vary widely and has no set timeline. It's important to note that market cycles can be unpredictable and can change rapidly, so crypto traders should always approach any cryptocurrency trading activity with caution and a long-term perspective.

Is trading during a bull market risky?

Yes, volatility during a bull market can be risky. While bull markets offer the potential for significant gains, they're also accompanied by significant risks, including scams, fraud, a lack of regulation, and cybersecurity threats.

Does a bull market mean to buy or sell?

In financial markets, a bull market generally refers to a market in which prices rise and confidence is high. This could be a good time to buy assets, as prices are expected to continue rising. In contrast, a bear market generally refers to a market in which prices are falling, and confidence is low, which can be a good time to sell assets.

Is it wise to buy in a bull market?

Buying when the stock market is going up (bull market) can be a smart move, as prices are generally increasing, and people feel good about the market. Diversification, dollar-cost averaging, and risk management strategies are all important when trading during a bull market.

Activele digitale, inclusiv criptomonedele stabile, presupun un grad ridicat de risc și pot fluctua foarte mult. Ar trebui să analizați cu atenție dacă tranzacționarea sau deținerea activelor digitale este potrivită pentru dvs. pe baza situației dvs. financiare și a toleranței dvs. la riscuri. OKX nu oferă recomandări pentru investiții sau active. Sunteți exclusiv responsabil pentru deciziile dvs. de investiții, iar compania OKX nu este responsabilă pentru nicio pierdere potențială. Performanța trecută nu indică rezultatele viitoare. Consultați un specialist în domeniul juridic/fiscal/al investițiilor dacă aveți întrebări despre circumstanțele dvs. specifice. Funcțiile OKX Web3, inclusiv OKX Web3 Wallet și OKX NFT Marketplace, sunt supuse unor termeni separați privind serviciile, pe care îi puteți accesa la www.okx.com.

© 2025 OKX. Acest articol poate fi reprodus sau distribuit în întregime sau pot fi folosite extrase ale acestui articol de maximum 100 de cuvinte, cu condiția ca respectiva utilizare să nu fie comercială. De asemenea, orice reproducere sau distribuire a întregului articol trebuie să menționeze în mod clar: „Acest articol are drepturi de autor atribuite OKX în anul 2025 și este utilizat cu permisiune.” Extrasele permise trebuie să menționeze numele articolului și trebuie să includă atribuirea, de exemplu „Numele articolului, [numele autorului, dacă este cazul], © 2025 OKX.” Nu este permisă nicio lucrare derivată sau alte utilizări ale acestui articol.