This is an OKX — Okcoin research partnership. Adam Bloom is a Content Writer, podcaster, and yield farmer based in Los Angeles.

Now that Ethereum has completed the Merge, it’s time to get ready for the next set of Ethereum upgrades — the Surge, Verge, Purge, and Splurge.

TL;DR

Ethereum’s long-anticipated Merge update has made the network over 99% more energy efficient and updated its consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS).

But the Merge has also prepared the network for subsequent upgrades to make the network cheaper, faster, and more decentralized.

When those upgrades are complete, the Ethereum Foundation predicts Ethereum could be able to process 100k transactions per second (TPS).

Once again…the Merge

Almost as soon as Ethereum launched in 2015, the Ethereum Foundation began discussing an upgrade from PoW to PoS. It took seven years, but this week, it happened. Ethereum’s update to PoS has arrived and should make the network over 99% more energy efficient.

Also, Ethereum will now pay smaller ETH rewards to PoS validators than it paid to PoW miners. As a result, Ethereum’s total issuance of new ETH should drop from 5M ETH per year to an amount calculated based on the formula 166*√(total ETH staked). A bit messy, but the result is that ETH issuance would likely go down. Way down. Possibly 90% down.

Some have compared this reduction to Bitcoin’s analogous process of “halving.” In a Bitcoin halving, the network reduces mining rewards by half to reduce Bitcoin’s inflation rate.

If ETH issuance does reduce by 90%, that would be like three halvings (do the math), a “triple halving.”

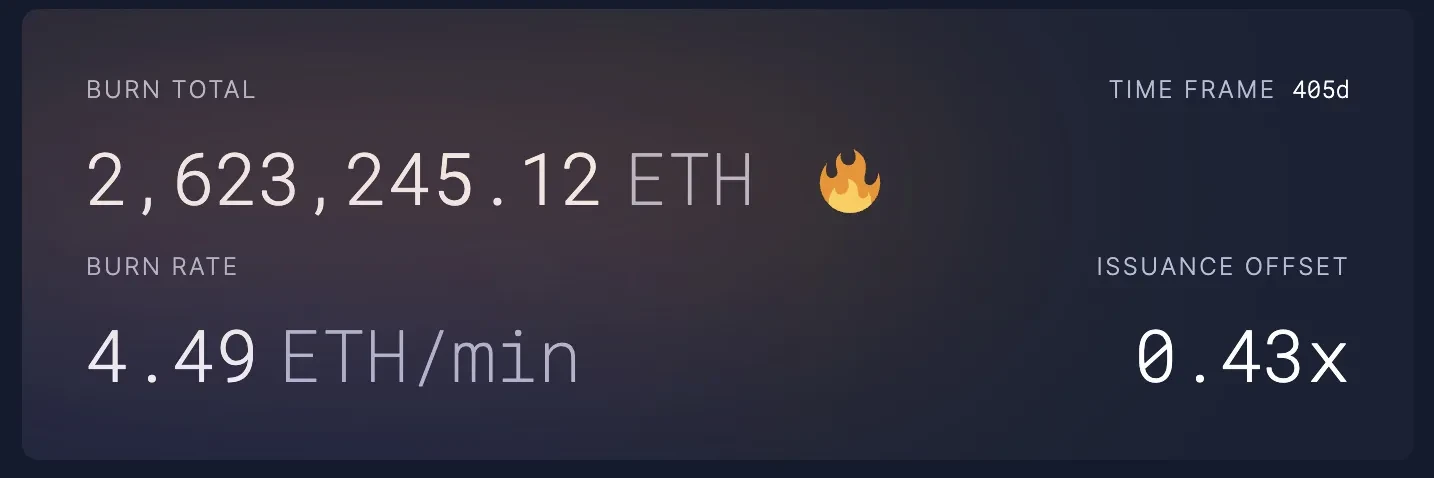

In addition, Ethereum adopted a new rule last summer, EIP-1559, which changed how the network processes user transaction fees (“gas fees”). Under EIP-1559, the network automatically “burns” gas fees rather than paying them to miners. That is, the network collects the ETH coins used to pay gas fees and removes them from circulation.

These two rules reduced ETH issuance under PoS and gas fee burning under EIP-1559 could make the post-Merge supply of ETH drop significantly.

So that’s the Merge. Now what?

Vitalik’s Ethereum roadmap

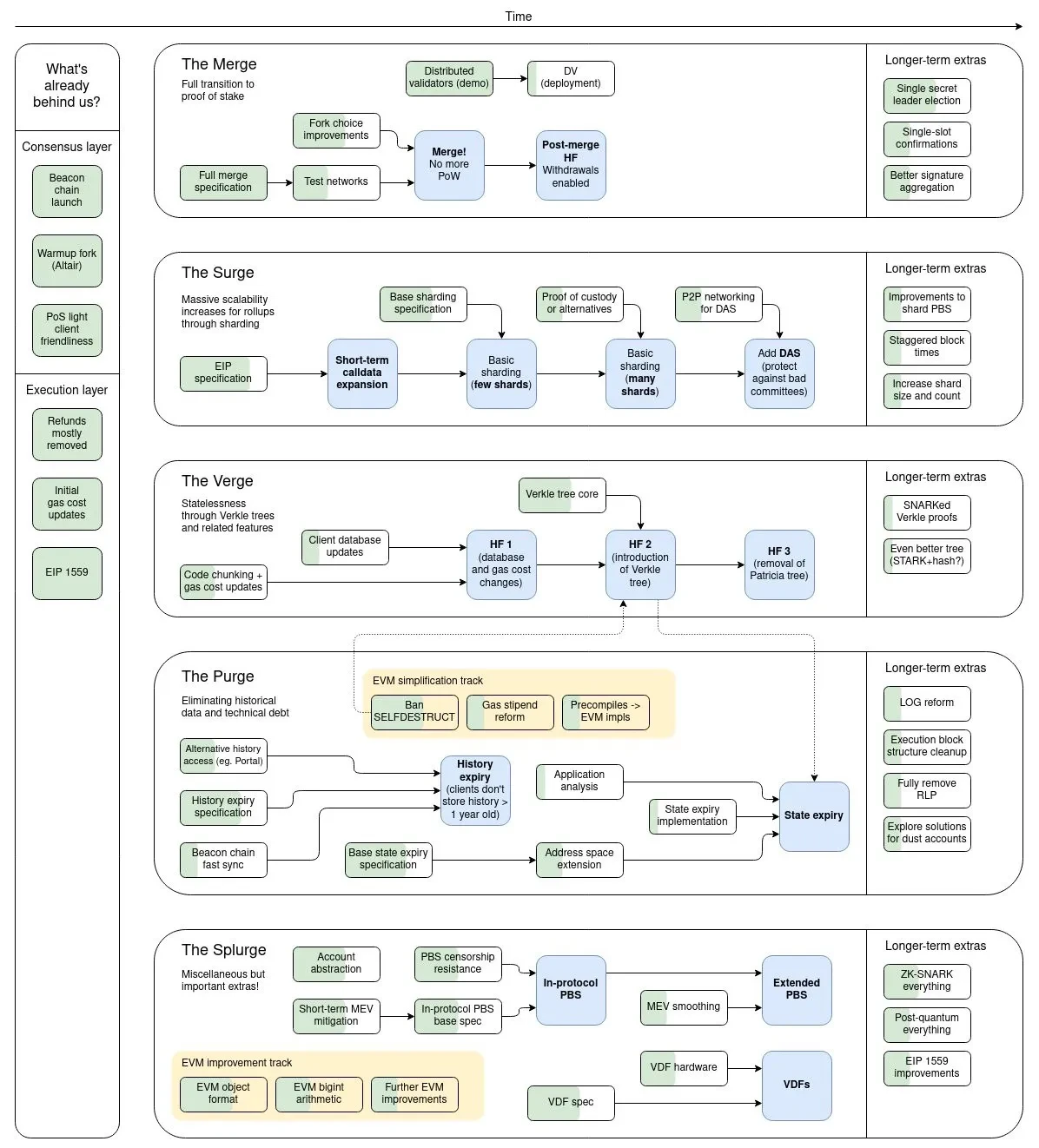

Next, Ethereum should pursue a series of complicated and ambitious network updates. And, in typical Ethereum “are you sure about this?” fashion, developers intend to pursue these updates all simultaneously, in parallel.

Here’s the whole plan… it’s a lot, ok? I’m just preparing you it’s — a little scary, but we’ll go through it together. Ready?

So, yeah… that’s a lot. I told you. It’s ok, breathe. Here’s what it all means.

First up, the Surge.

The Surge: scaling with shards

If you like using Ethereum’s mainnet for your Web3 transactions, there’s bad news Vitalik wants you off there. Ethereum’s mainnet has been overrun for at least a year with DeFi, NFT mints, and dog coin transactions causing gas fees to explode.

There are two basic ways to address this kind of blockchain congestion. One is to grow the blockchain’s capacity to process transactions on its mainnet. Solana has taken this approach but it comes with tradeoffs. On the one hand, Solana can process over 200k transactions per second on its mainnet. On the other hand, the network has faced repeated technical challenges.

Ethereum is taking the other approach, which is to move as many transactions as possible off the mainnet and onto “Layer 2,” a collection of Ethereum-compatible blockchains, sidechains, and rollup protocols attached to Ethereum like barnacles on a whale.

Even before the Merge, a large and growing collection of these Layer 2 scaling protocols had already amassed billions of dollars of total value locked on their chains. They include Polygon, Avalanche, Arbitrum, Optimism, and new ones joining daily.

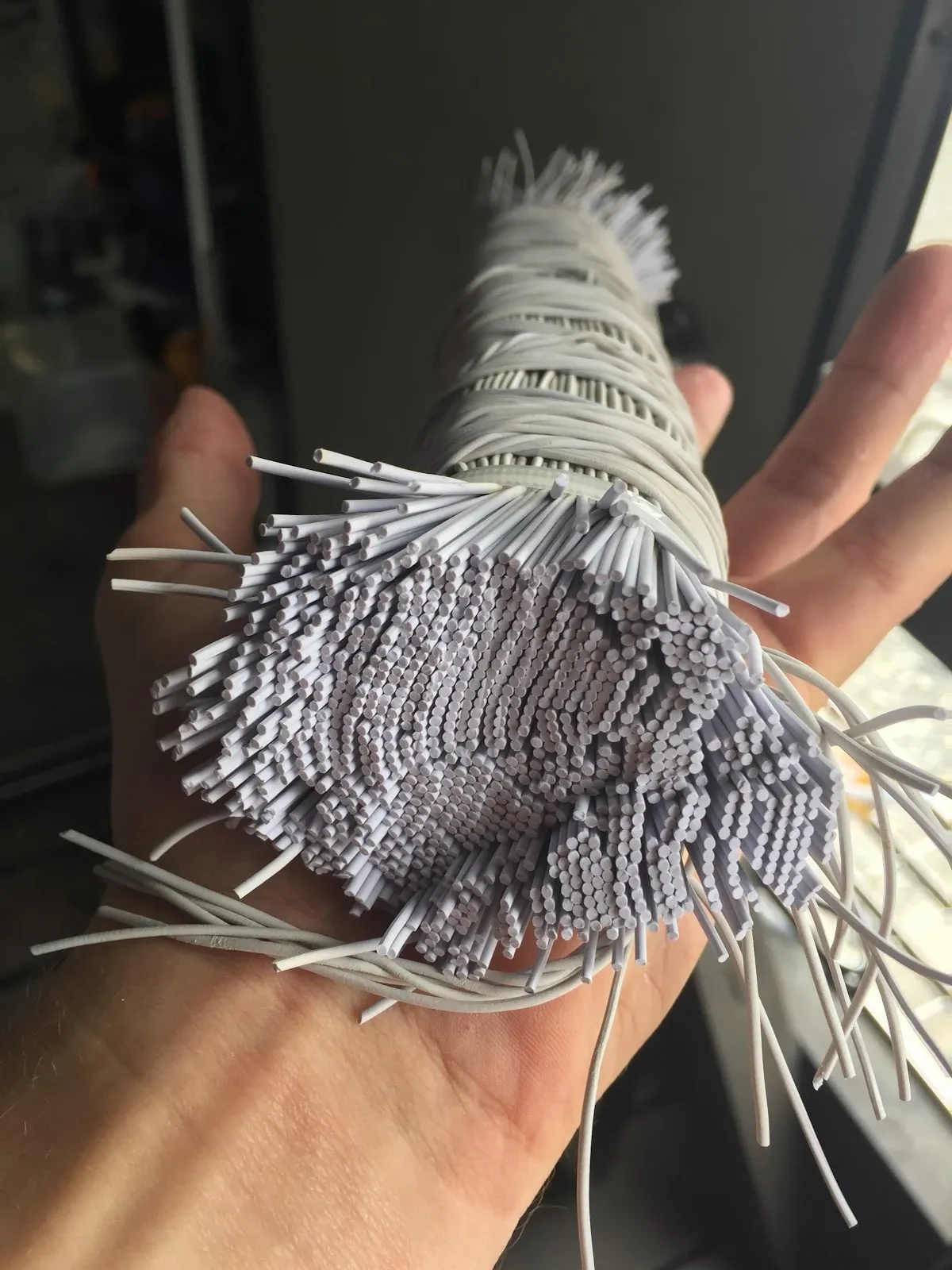

With the Surge, Ethereum will add native sidechains, called “shards,” to Layer 2. These shards will roll out gradually until there are 64 of them. At that point, Ethereum will look less like a single chain and more like a bungee cord, which looks like this if you bisect it.

After the Surge, Ethereum would have this kind of multichain structure, except with one large chain, the Ethereum mainnet, running through the middle of it like a spine.

All the Layer 2 protocols, including the Ethereum shards and the third-party scaling protocols, would process transactions away from Ethereum’s mainnet. Then, Layer 2 would send bundles of transactions back to Ethereum’s mainnet for the network to record in the Ethereum ledger. The Ethereum Foundation estimates that once this process is complete, Ethereum could jump from a network throughput of 15 TPS to 100k TPS.

This extra data capacity could reduce the cost of processing Layer 2 transactions by an estimated 90%. Currently, gas fees on these Layer 2 protocol range from less than a cent to perhaps $0.30. Subtract 90% of that cost, and you could have a network cheap enough to use for everyday internet activities like social media and gaming.

If that happens, Ethereum could become not just a place for degens to speculate on crypto trading, DeFi, and NFTs, but a truly decentralized global computer for everyday use.

And while that’s happening, Ethereum would also be even further under the hood, working on the Verge.

The Verge: preparing for stateless clients

Look, there’s no easy way to say this. Let’s just get it out there and then we can move on:

Ethereum is updating the cryptographic proof methodology it uses to validate transactions from a Merkle tree structure to a Verkle tree structure.

Does anyone actually know what this means? Well, Vitalik does, and he’s very excited about it.

But don’t be ashamed if you feel more like this guy. The upshot is that Verkle trees allow cryptographic proofs to use much less data than Merkle trees. An Ethereum node validating transactions using Merkle trees must know the entire state of the Ethereum network. That’s a lot of data. It takes a big computer to hold and process it all.

But an Ethereum node validating transactions using Verkle trees could do so with minimal information about the state of the Ethereum network. With so much less data, the validator could function as a stateless client. This means Ethereum validator nodes could run on less powerful computers. That makes Ethereum validators smaller, cheaper, and more portable, which encourages decentralization.

But even if the Verge allows you to run a validator node without knowing the current state of the network, you still need to store the Ethereum ledger, the entire past state of the network. This brings us to the Purge.

The Purge: unloading the ETH ledger

The Ethereum ledger is currently just over 1020 GB of data and is getting bigger every moment. If you run an Ethereum validator node, you must store all 1020 GB on your machine and make sure you have room for more as it grows.

The Purge would fix this. EIP-4444 proposes to do away with the requirement that every Ethereum node stores the complete Ethereum ledger. This update would make it even cheaper to be an Ethereum validator. In fact, Vitalik has said he wants Ethereum users to be able to validate Ethereum transactions with their smartphones. In case you don’t have enough apps to check frantically every 30 seconds.

And what’s left?

The Splurge: everything else

The Splurge is a miscellaneous list of other Ethereum updates. They fit with the themes of the other Ethereum updates make the network faster, cheaper, more scalable, more decentralized, and drive activity to Layer 2.

Despite Ethereum’s amazing progress in the past seven years, these are still its early days. As Ethereum rolls out these updates or fails to do so, the next few years will reveal whether the network is able to fulfill its vision as a decentralized world computer and the backbone of Web3.

In the meantime, it’s been a remarkable week for Ethereum and Web3. Take a moment, have a drink, and celebrate.

© 2024 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2024 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2024 OKX.” No derivative works or other uses of this article are permitted.