Pegged as one of crypro's biggest comeback stories to date, Solana's rebound has been astounding, with SOL's price appreciating more than ten times from its December 2022 lows. With Solana currently sitting at a market cap of over 40 billion, is now the right time to lock in those massive SOL gains or does Solana have more room to run?

Using our Solana price prediction guide, you'll can draw your own conclusions as we dive into Solana's support and resistance levels and make use of basic technical analysis to highlight potential Solana price movements and trading opportunities. From knowing what Solana's catalysts are to considering Solana charts, here's everything you need to know when understanding how to trade Solana.

What is Solana?

Solana is a Layer 1 blockchain platform that's popular for its unmatched scalability and security. Compared to other Layer 1s, Solana achieves a staggering throughput of up to 65,000 transactions per second (TPS). This is due to its introduction of innovations like Proof of History (PoH) and tower Byzantine Fault Tolerance (BFT). Thanks to such features, Solana has earned a reputation for being highly efficient and cost-effective as its scalability and affordable gas fees make it a popular choice among beginner crypto traders and DeFi natives alike.

Solana updates: why SOL led the 2023 rally

Solana is one of the big winners in the 2023 crypto rally. Despite its billion-dollar market cap and reputation as one of the large caps in the crypto market, this hasn't stopped traders from buying Solana hand over fist throughout 2023. Are you curious about what Solana-specific news caused the Solana rally, aside from the Bitcoin ETF development that caused a market-wide improvement in sentiment towards cryptocurrencies? Here are a few possible reasons as to why SOL prices rallied in 2023.

Improved Solana network stability with Firedancer

There's no blockchain network more associated with outages and crashes than Solana. Much to the dismay of Solana bulls and enthusiasts, Solana faced constant network crashes throughout the 2021 crypto bull market. This is because of Solana's unique architecture that relies on PoH for transaction ordering. While this design allows for faster transaction speeds and lower fees, it also introduces vulnerabilities that range from increased congestion susceptibility to massive denial-of-service attacks under high transaction volume. During periods of high activity, this could cause the Solana network to temporarily break down and halt block production.

Thankfully, the arrival of Firedancer represents a significant upgrade to Solana's core infrastructure as there's now greater validator diversity within the Solana ecosystem. As a third-party validator client software, Firedancer joins the likes of Jito Labs and Solana Labs in Solana's list of validator clients promising to bolster Solana network stability and transaction processing capabilities while promoting greater validator pool decentralization.

Strategic collaborations for mainstream adoption

Solana's partnerships with commerce and payment giants like Shopify and Visa to provide Solana Pay have opened doors for mainstream adoption by offering familiar access points for users unfamiliar with Solana. These collaborations signal the potential of Solana's technology in real-world applications and how its scalability can be used to revolutionize the FinTech landscape. In forging such partnerships, the Solana user base will benefit from the creation of a positive network effect that further develops the Solana ecosystem as more users and businesses hop on the Solana bandwagon. Furthermore, working with established brands and showcasing real-world applications in e-commerce and cross-border payments enhances trust and legitimacy for Solana's innovative technology, possibly attracting those curious about Solana's potential to transform the FinTech landscape.

DeFi growth and increased TVL

Solana's DeFi ecosystem has experienced significant growth in recent months. This is indicated by a near ten-fold surge in the total value locked since the beginning of 2023 as the Solana network continues to develop its DeFi infrastructure, attracting various DApps like Jito and Jupiter Aggregator which contribute to a more diverse and robust Solana DeFi ecosystem.

The emergence of such up-and-coming DeFi projects provides compelling use cases for SOL beyond governance and staking, further fueling demand and potentially driving long-term SOL price appreciation. Additionally, the synergistic relationship between these DApps and the underlying Solana blockchain can lead to increased adoption of the entire Solana ecosystem as a self-reinforcing cycle is established that can solidify Solana's position as a major player in the DeFi landscape. As more users and developers are attracted to the growing DeFi ecosystem, it fuels further innovation and development within the DApps themselves. In turn, this attracts even more users and creates a positive feedback loop that strengthens the entire Solana ecosystem.

SOL price movements

Looking at the 52-week performance of SOL, Solana has enjoyed a blistering 378% bullish rally that's taken the crypto community by storm. Since hitting lows of $12.67 in June 2023, SOL has managed to achieve 52-week highs of $126.65 before experiencing a minor pullback. Since testing the $79 support, SOL prices have swiftly recovered and the asset has a last-traded price of $112.08 as of February 27, 2024.

Like other altcoins, SOL seems to have enjoyed a decent rally thanks to the bullish catalysts mentioned above and a market-wide price appreciation thanks to the excitement introduced by the spot Bitcoin ETF. With speculation of a spot ETH ETF in the works, we might see further SOL rallies in the making that'll retest the $125 supply zone as Layer 1 coins benefit from the increased interest in Bitcoin alternatives.

SOL technical analysis

With a 52-week range of $12.67 to $126.65, it's clear that Solana can experience a high level of volatility. While it may be difficult to accurately predict SOL's price in the near-term, we can use technical analysis and trading indicators to create a trading plan and come to our own conclusions on where SOL is headed over time. In the example below, we'll be making use of popular technical analysis indicators like the simple moving average and the relative strength index while referring to SOL's price as of February 27, 2024.

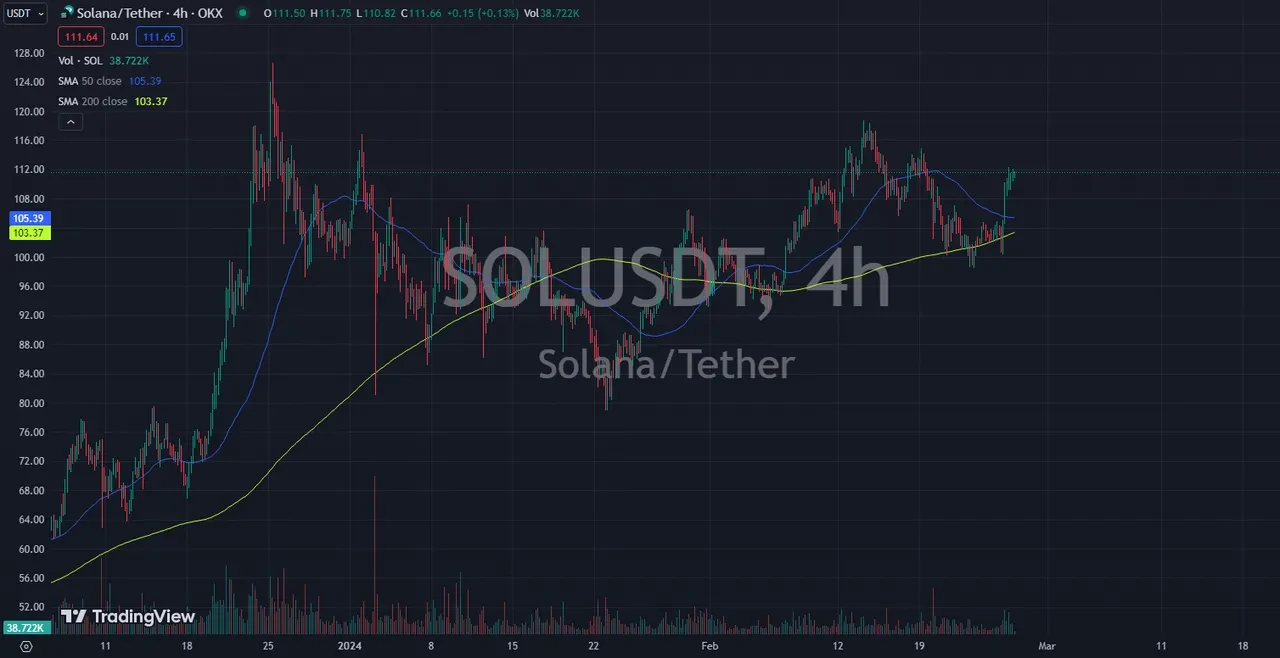

Simple moving average (SMA)

As one of the key technical indicators crypto traders use for overall trend analysis, SMA refers to the average price of an asset over a specified time period. Referring to the chart above, the specified time frame will be 50 days and 200 days respectively. Instead of just referring to the moving averages for SOL's average price across a time frame, what crypto traders will look out for is when both moving averages cross. When the 50 SMA crosses below the 200 SMA, a death cross appears, which hints to traders that there's an exhaustion of bullish momentum for SOL. This was the case in late January, as SOL prices plunged as low as $78.94 before gradually recovering.

On the other hand, when the 50 SMA crosses above the 200 SMA, a golden cross occurs. This typically hints at an impending bullish rally, as was the case for SOL's price in early February as SOL prices began to surge from $96 to as high as $118.71. Currently, with the 50 SMA about to cross below the 200 SMA on the four-hour time frame, we might witness a minor correction to SOL's price based on the analysis of simple moving average crossovers as a death cross may start to form once bullish momentum gets exhausted.

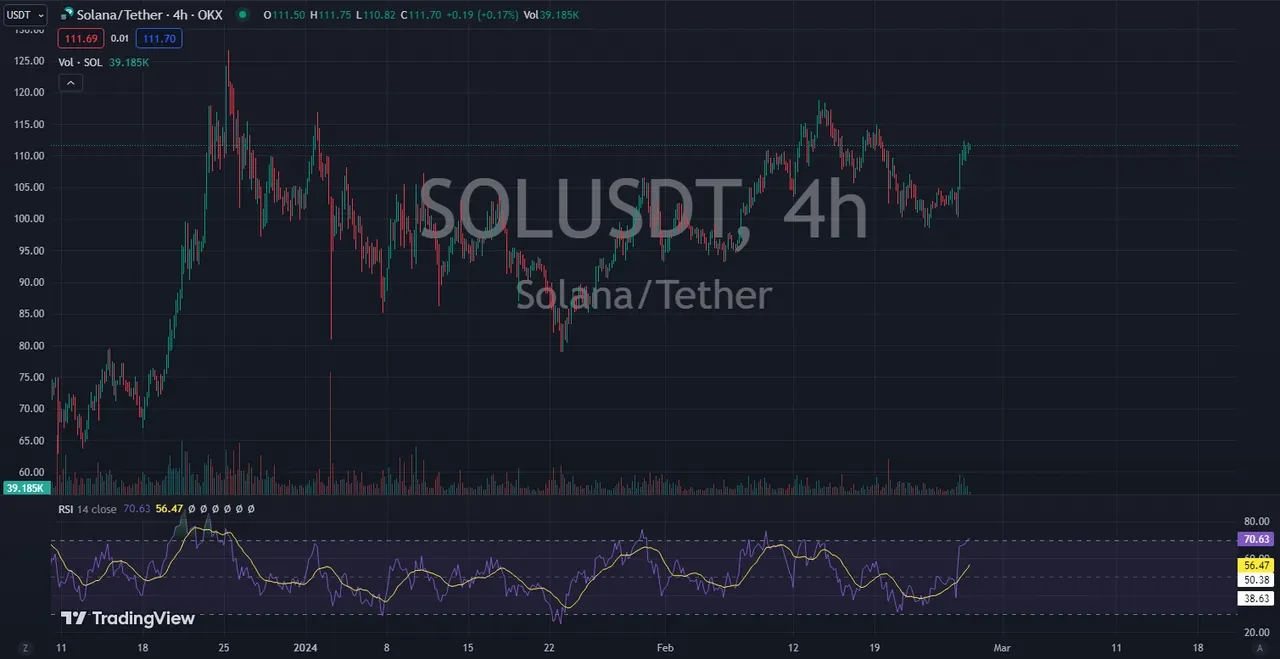

Relative strength index (RSI)

Put simply, RSI is a lagging momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. Most crypto traders use it as an indicator to determine the cryptocurrency's general trend and gauge the momentum behind the price movements. RSI values over 70 are typically a sign that an asset is overbought and can experience a correction in its value.

Conversely, an RSI of 30 or under indicates that an asset is currently oversold and undervalued by crypto traders. In this case, the RSI of SOL on the four-hour time frame sits at 70.63. This implies that the recent Solana rally has plenty of bullish momentum behind it, pushing it to an overbought status. Although SOL could continue rallying, its RSI is signaling that Solana is overbought and might face a price correction in the near-term. This trend might be something to take note of if you're intending to trade SOL.

Solana price predictions

If you're a new crypto trader that's unfamiliar with the price action and fundamentals of SOL, you'll likely be looking out for Solana price predictions since that might give you a rough gauge of the overall sentiment towards SOL.

As with all crypto price predictions, they should be taken with a large grain of salt, since they're subjective opinions that may carry a certain level of bias that could be impacted by current overall market sentiment. For all analyst perspectives presented in this section, we'll be looking at Solana price predictions for 2024 and 2025 as of February 27, 2024.

Predictor | SOL price 2024 | SOL price 2025 |

|---|---|---|

Changelly | $51.46 | $220.21 |

Coinpedia | $145 | $179.95 |

Coincodex | $148.39 | $308 |

Ambcrypto | $101.56 | $34.20 |

Coinswitch | $113.93 | $168.77 |

Based on most of these Solana price predictions, we can see that analysts are largely bullish with their SOL price predictions as most of them expect some upside to Solana for the remainder of 2024 for both bull and bear cases. This seems to be the case with SOL price averages for 2025 too, as most analysts are bullish for the long-term future of SOL.

What are Solana's catalysts?

There are many factors to consider before deciding to trade SOL and it's wise to have a balance of bullish and bearish views while doing your due diligence. Before diving into a trade, it's key to know what catalysts will impact Solana prices, so you can plan trades off events that'll cause SOL price volatility.

One of the major driving factors for Solana prices and overall sentiment is the Solana network's ability to deal with outages. As previously mentioned, the Solana network is notorious for experiencing downtime and halting block production. With network stability solutions like Firedancer and Sig on the way to the Solana mainnet, Solana seems to have finally found a way to stave off downtime and achieve its potential of being a major driver of transactions. While it's still too early to say that Solana is outage-free given the recent five-hour network outage, the team is certainly making progress towards fixing this issue.

Another factor worth noting is Solana's ever-growing ecosystem that stems from experimenting with new and innovative projects. From kickstarting the move-to-earn movement with StepN to revolutionizing GameFi with titles like Star Atlas, Solana's reputation for fostering innovation across various blockchain use cases that extend beyond DeFi is unmatched in the crypto space. These examples showcase Solana's ability to attract and nurture groundbreaking projects across diverse applications, potentially solidifying its position as a versatile and adaptable blockchain network in the ever-evolving Web3 landscape.

Final words and next steps

From understanding why Solana rallied to running through basic technical analysis for SOL, we hope our guide on how to trade SOL has proved useful. Despite signs that the market might need some time to cool off given all the bullish momentum, many Solana enthusiasts and bullish traders are insistent that the Solana rally still has a way to go as SOL prices march on to reclaim an all-time high. Ultimately, only time will tell if Solana will continue to excel in the crypto space as a unique and novel blockchain network that possesses the ability to harness hyper scalability.

Keen to learn more about SOL? Get started by visiting our Solana price page for more information.

FAQs

Where can I trade Solana?

You can trade SOL with us through the various Solana spot trading pairs available.

What factors should I consider before trading Solana?

Before committing to a Solana trade, you're encouraged to build a trading plan and execute it when Solana reaches your planned price levels. The trading plan should take into account Solana's strengths and the current sentiment of the market so you can make the most informed trade possible.

What type of wallet do I need to store Solana?

Solana uses its own blockchain, so standard wallets used for other cryptocurrencies like Bitcoin or Ethereum won't work. With the OKX Web3 Wallet, you can effortlessly handle thousands of DApps and more than 80 networks with a single, universal crypto wallet.

What are the fees associated with trading Solana?

Standard trading fees apply when it comes to trading Solana, more of which can be found on the OKX fees page.

Is it legal to trade Solana in my region?

The legality of crypto trading can vary from region to region. Be sure to research and understand the regulations in your jurisdiction before participating in any SOL trading activities.

© 2024 OKX. Il presente articolo può essere riprodotto o distribuito nella sua interezza, oppure è possibile utilizzarne degli estratti di massimo 100 parole, purché tale uso non sia commerciale. Qualsiasi riproduzione o distribuzione dell'intero articolo deve inoltre riportare la seguente dicitura: "Questo articolo è © 2024 OKX e utilizzato con relativa autorizzazione". Gli estratti consentiti devono citare il titolo dell'articolo e includere l'attribuzione, ad esempio "Titolo articolo, [nome dell'autore, se applicabile], © 2024 OKX". Non sono consentite opere derivate né altri utilizzi di questo articolo.