Nejčastější dotazy ohledně pravidel poplatků za obchodování

1. Kdy dojde k zaúčtování poplatků pro takery a makery? Jaký je rozdíl mezi poplatkem pro takery a makery?

K objednávce takera dojde, když zadáte obchod, který je okamžitě vyřízen proti objednávce, která je již zadaná v objednávkové knize. Za objednávky takera je účtován poplatek podle sazby poplatku pro takery.

K objednávce makera dojde, když zadáte objednávku, která se zapíše do objednávkové knihy se stanovenou cenou a množstvím, například limitní objednávka, která zůstane v objednávkové knize, dokud nebude spárována.

Za objednávky makera je účtován poplatek podle sazby poplatku pro makery. Objednávky makerů zvyšují likviditu objednávkové knihy, a tím zvyšují hloubku trhu. Naproti tomu objednávky takerů snižují likviditu tím, že vyřizují objednávky z objednávkové knihy, a tím snižují hloubku trhu. Aby byly makeři motivovaní k poskytování likvidity, jsou poplatky makerů obvykle nižší než poplatky takerů. Podrobná pravidla naleznete v našem sazebníku poplatků.

2. Jak zjistím aktuální sazby poplatků a jaké jsou sazby poplatků pro různé úrovně?

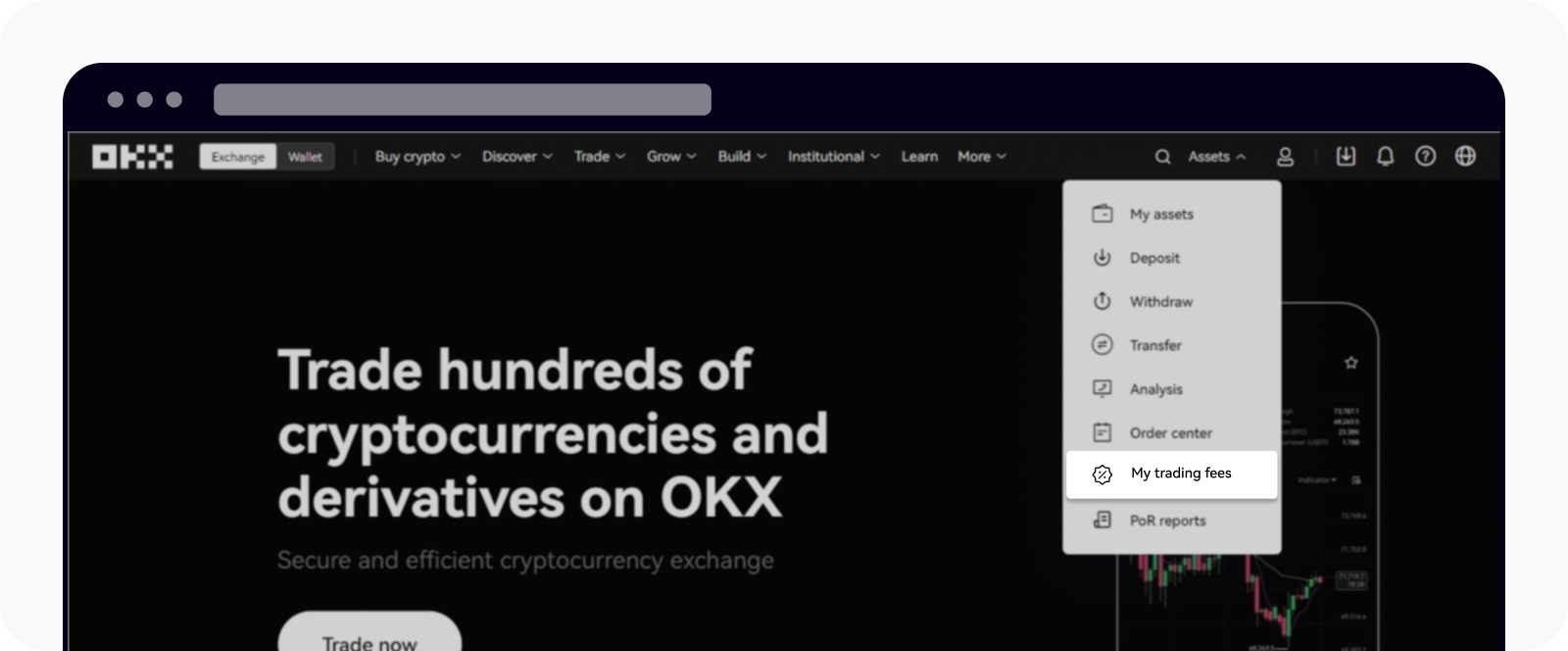

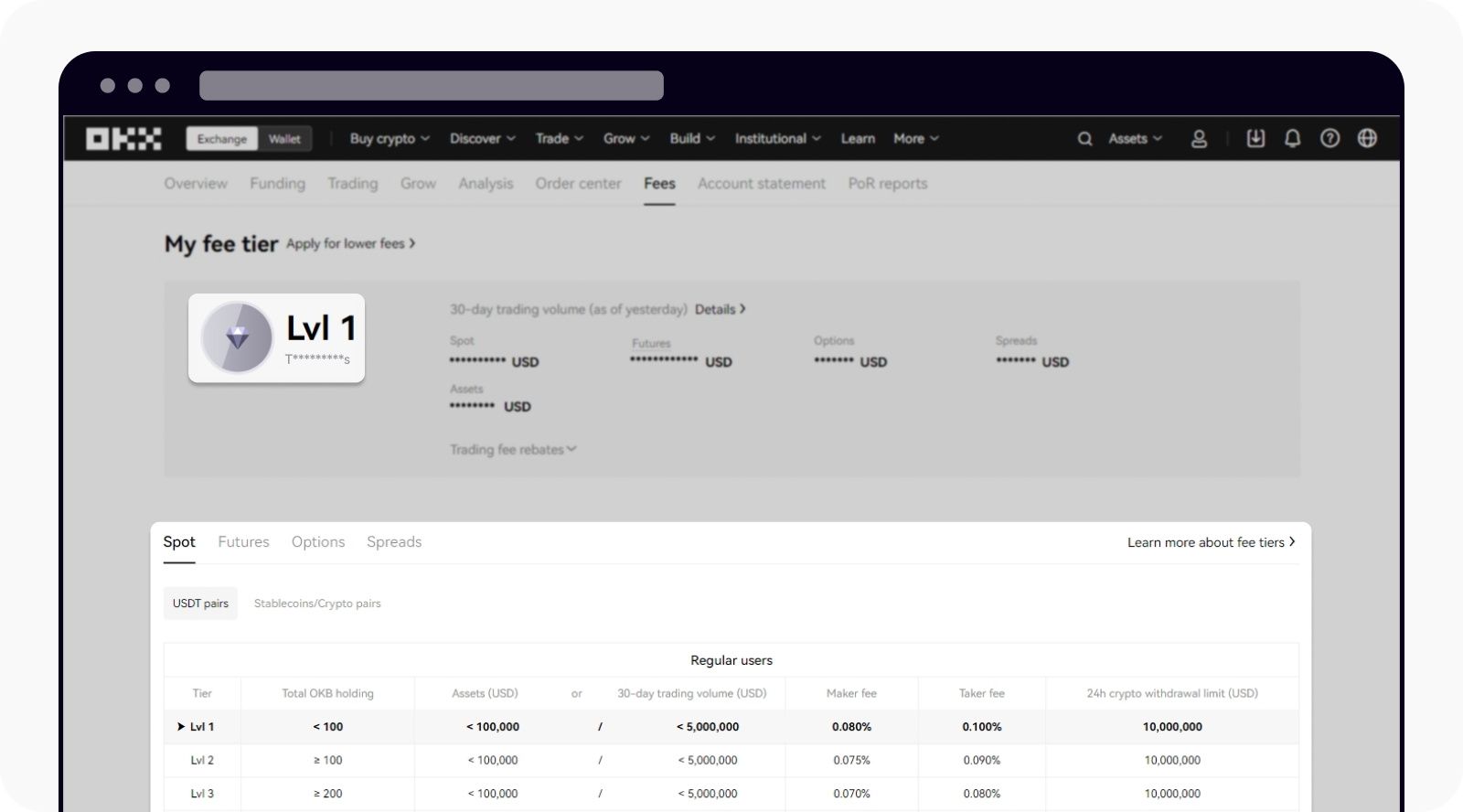

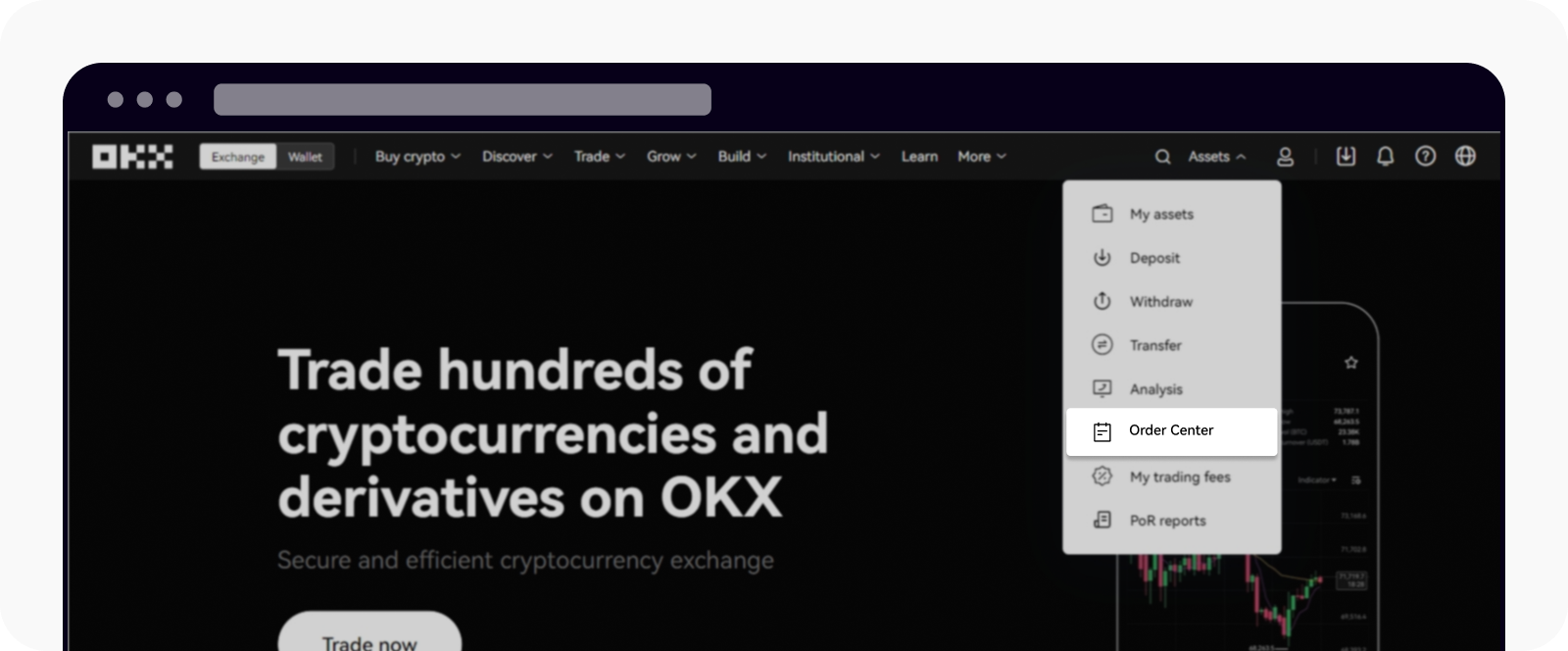

Na našich webových stránkách se můžete přihlásit ke svému účtu a přejít na Aktiva > Moje poplatky za obchodování. Svou aktuální úroveň poplatků a sazebník poplatků za obchodování, který obsahuje sazby poplatků pro jednotlivé instrumenty a obchodovatelné páry, najdete v nabídce Moje úroveň poplatků.

Otevřete stránku Moje poplatky za obchodování

Zjistěte svou aktuální úroveň poplatků a sazbu poplatků pro různé úrovně na stránce Moje poplatky za obchodování

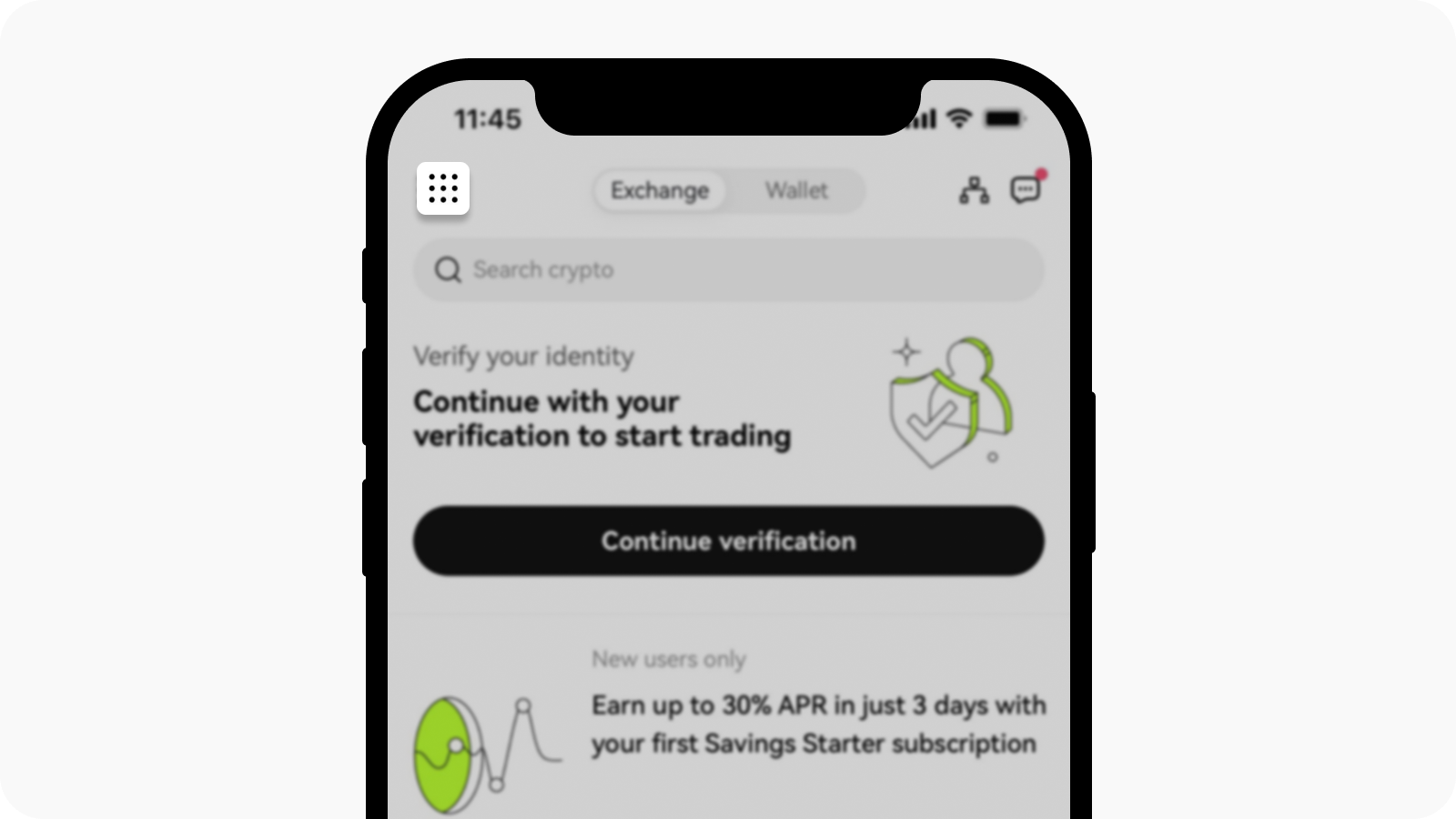

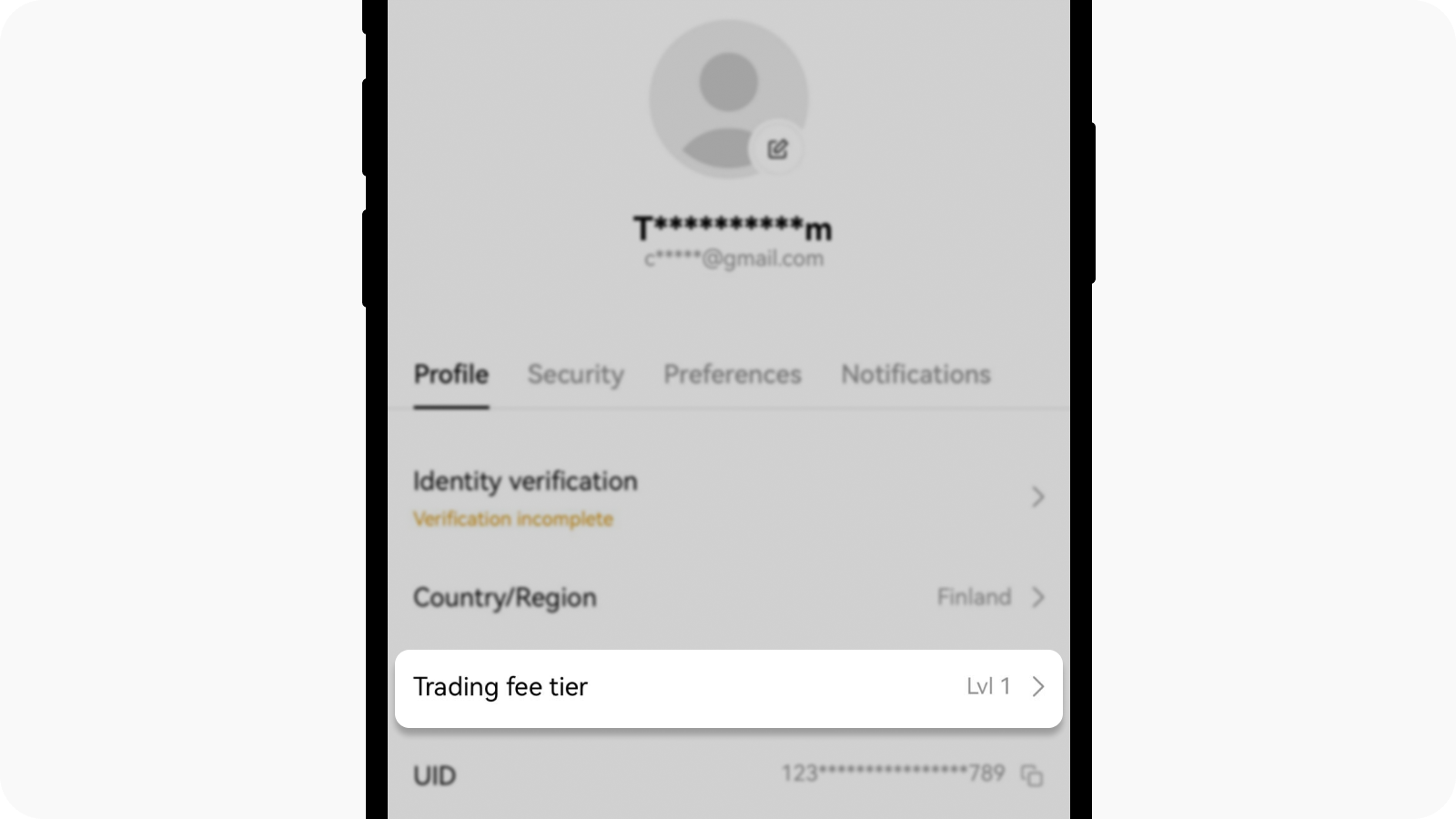

Případně se můžete přihlásit ke svému účtu v naší aplikaci a přejít na Uživatelské centrum > Profil a nastavení > Profil > Úroveň poplatku za obchodování. Svou aktuální úroveň poplatků a sazebník poplatků za obchodování, který obsahuje sazby poplatků pro jednotlivé instrumenty a obchodovatelné páry, najdete v nabídce Moje úroveň poplatků.

Otevřete nabídku uživatele z domovské stránky

Otevřete stránku úrovní poplatků za obchodování, kde si zobrazíte podrobnosti o poplatcích za obchodování

3. Jak zjistím aktuální sazbu poplatků pro konkrétní pár na stránce obchodování?

Můžete přejít na naši stránku obchodování a vyhledat požadované obchodovatelné páry. Sazby poplatků aktuálního obchodovatelného páru najdete v nabídce Poplatky na Panelu pro zadávání objednávek.

Aktuální výši poplatku pro makery a takery najdete na naší stránce obchodování

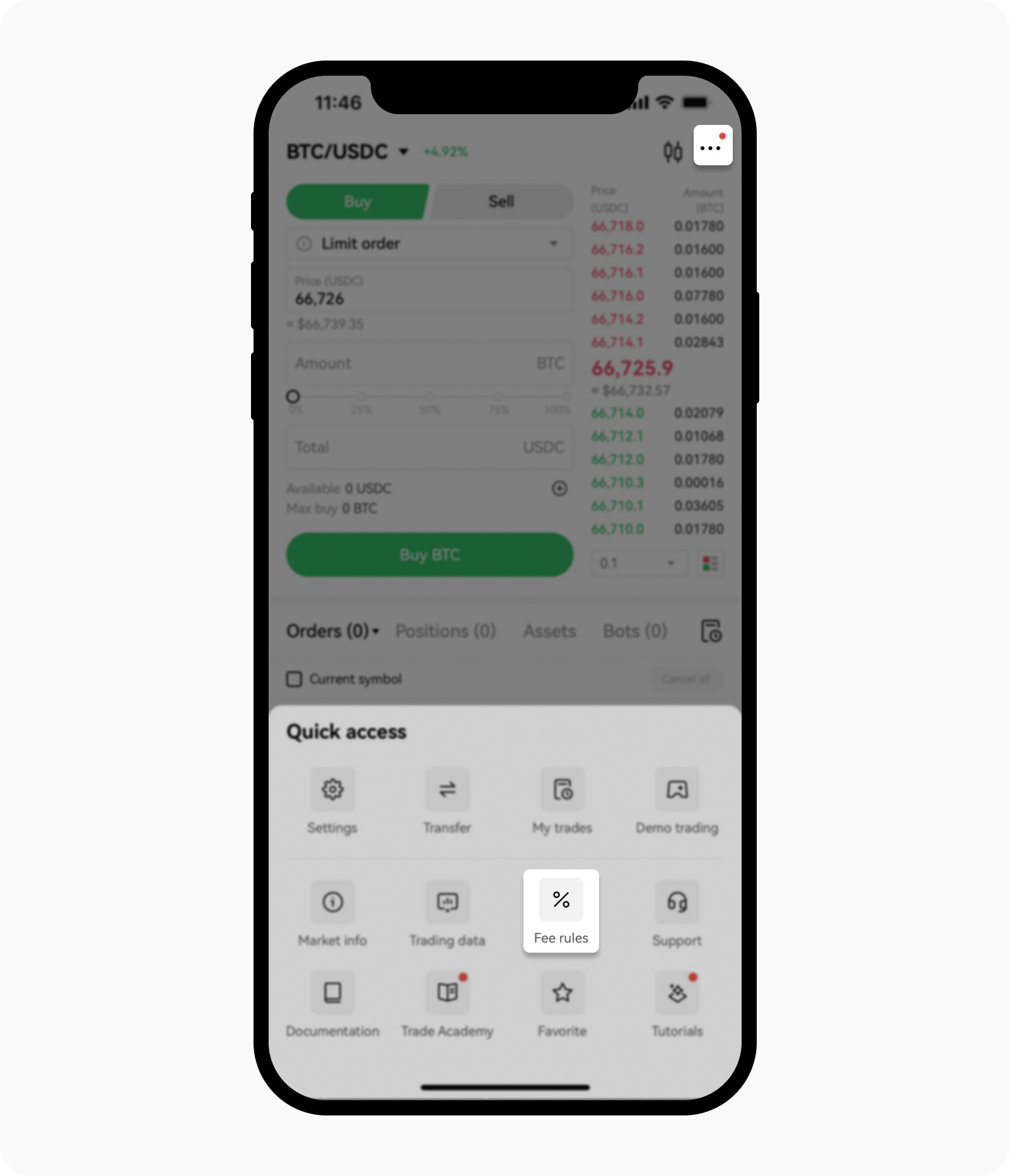

Případně se můžete přihlásit ke svému účtu v naší aplikaci, poté přejít na Obchodovat, vybrat Další a Pravidla poplatků a zjistit výši a sazbu poplatků pro aktuální pár.

Výběrem možnosti Pravidla poplatků zobrazíte další informace o své aktuální úrovni poplatků a pravidlech

4. Jak zjistím poplatky za své minulé objednávky?

Poplatky za minulé objednávky najdete na webu v následujících sekcích:

Ze stránky Obchodování > Historie objednávek

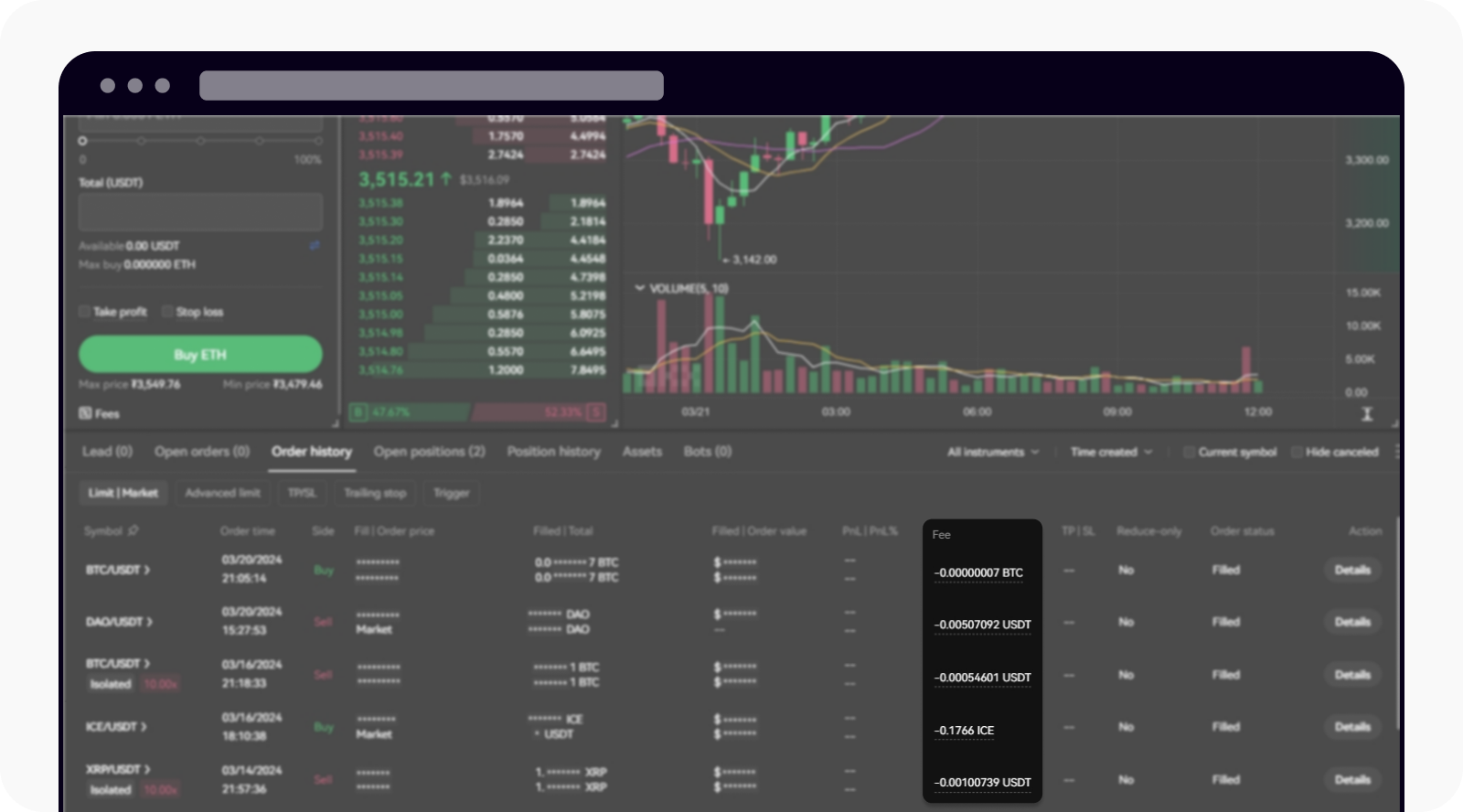

Přejděte na naši stránku Obchodování a vyberte Historie objednávek. Zobrazí se výše uplatněného poplatku.

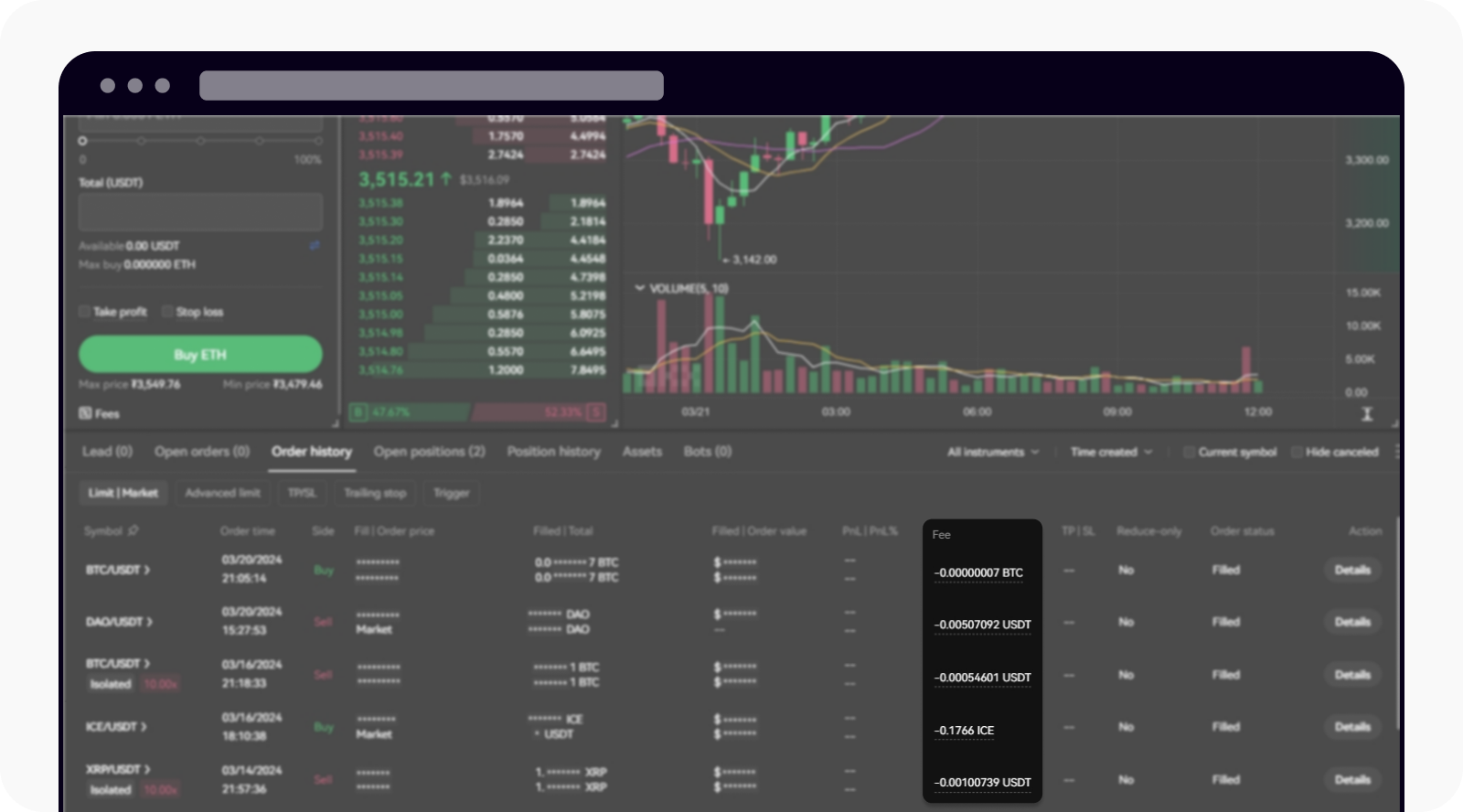

Výši poplatku vyhledáte v historii objednávek

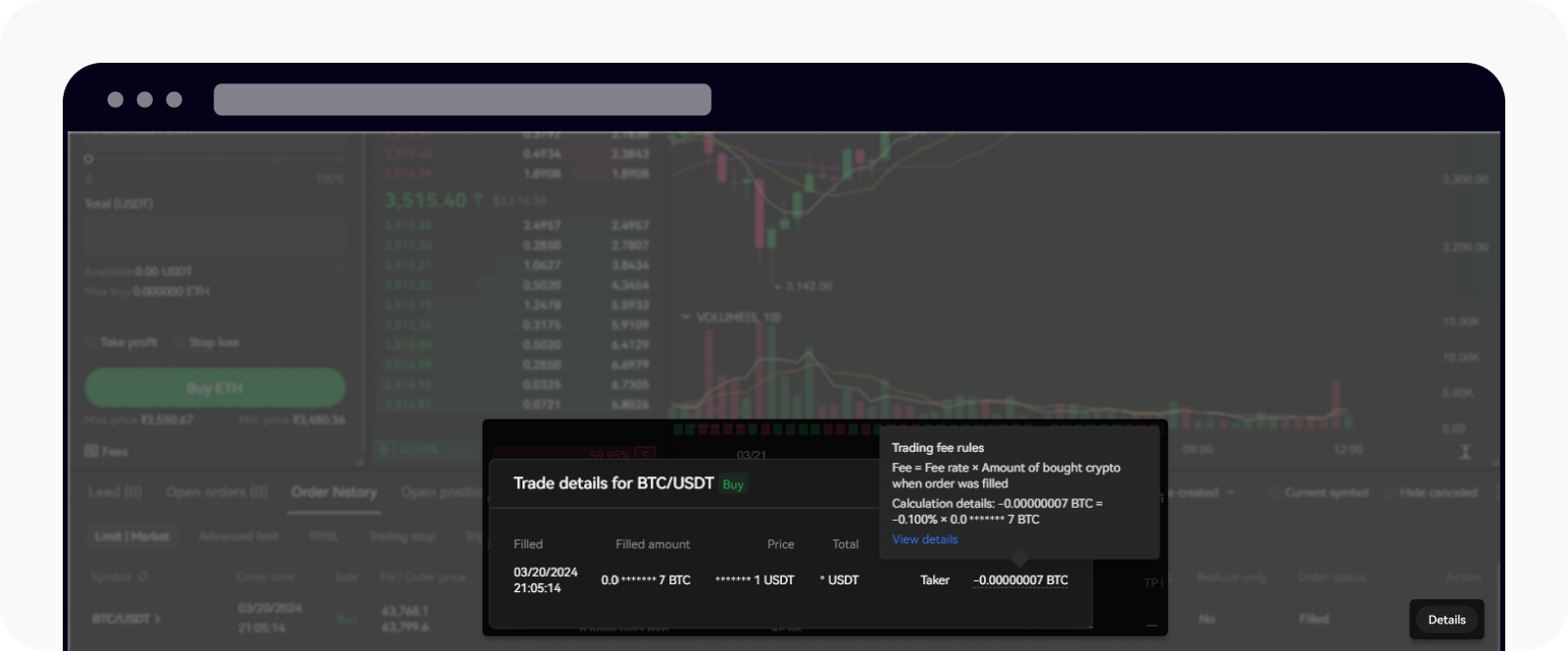

Pokud se chcete podívat na způsob výpočtu poplatku, můžete vybrat Podrobnosti a najet myší na Poplatek.

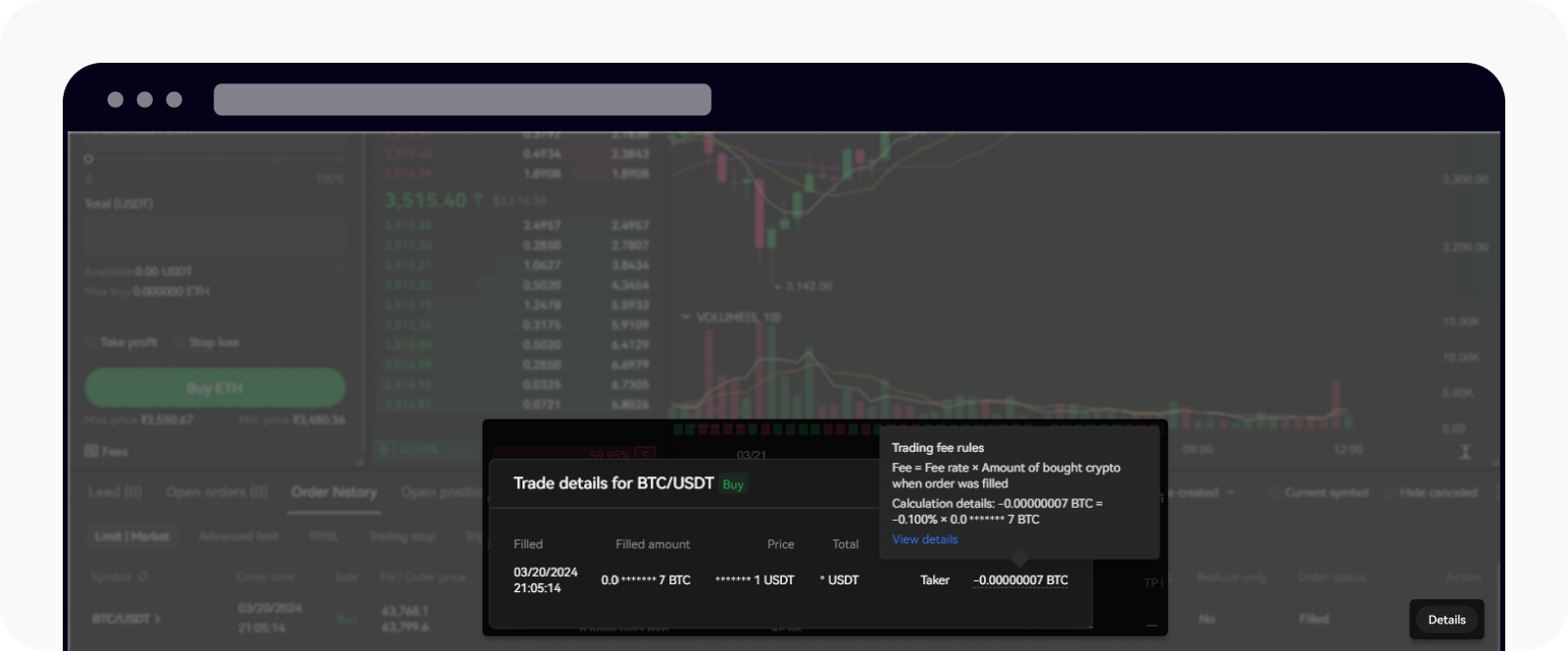

Vyberte podrobnosti a zjistíte, jak byl poplatek vypočten

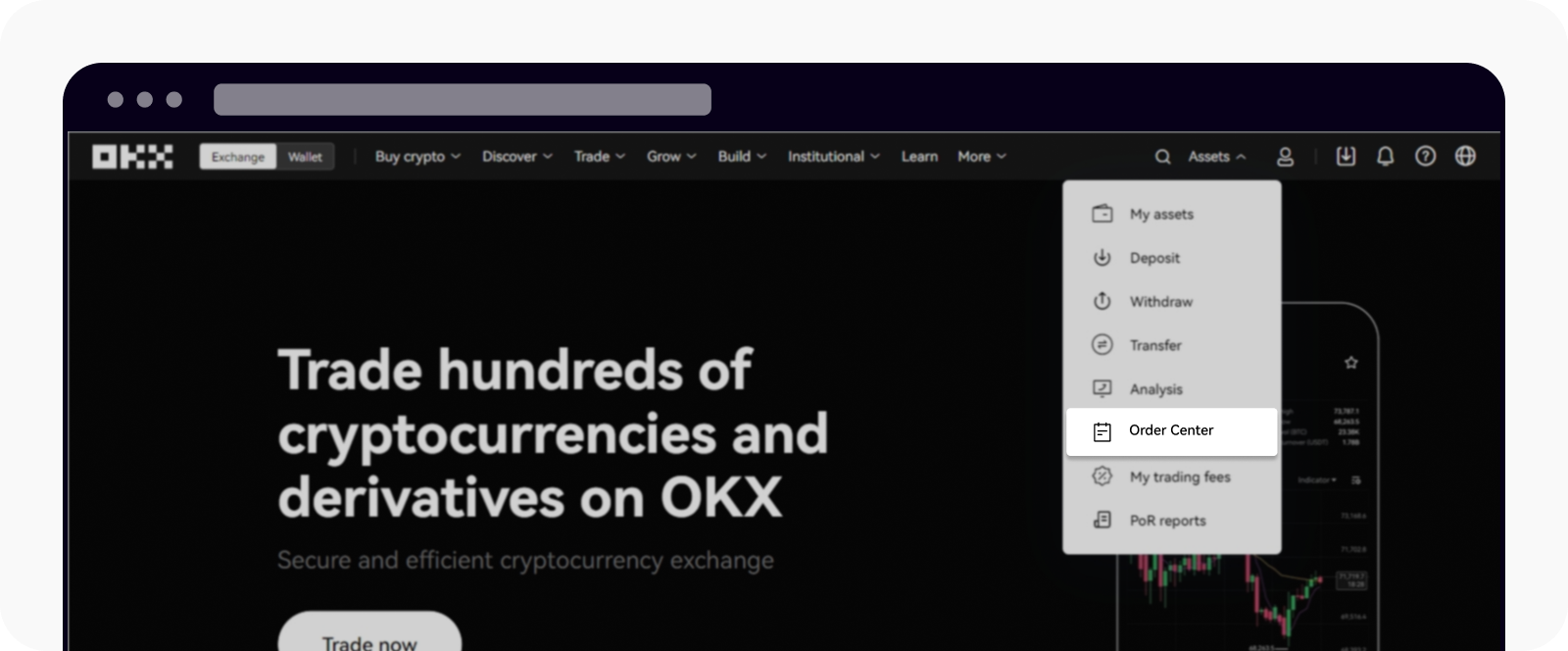

Z nabídky Objednávkové centrum > Historie objednávek

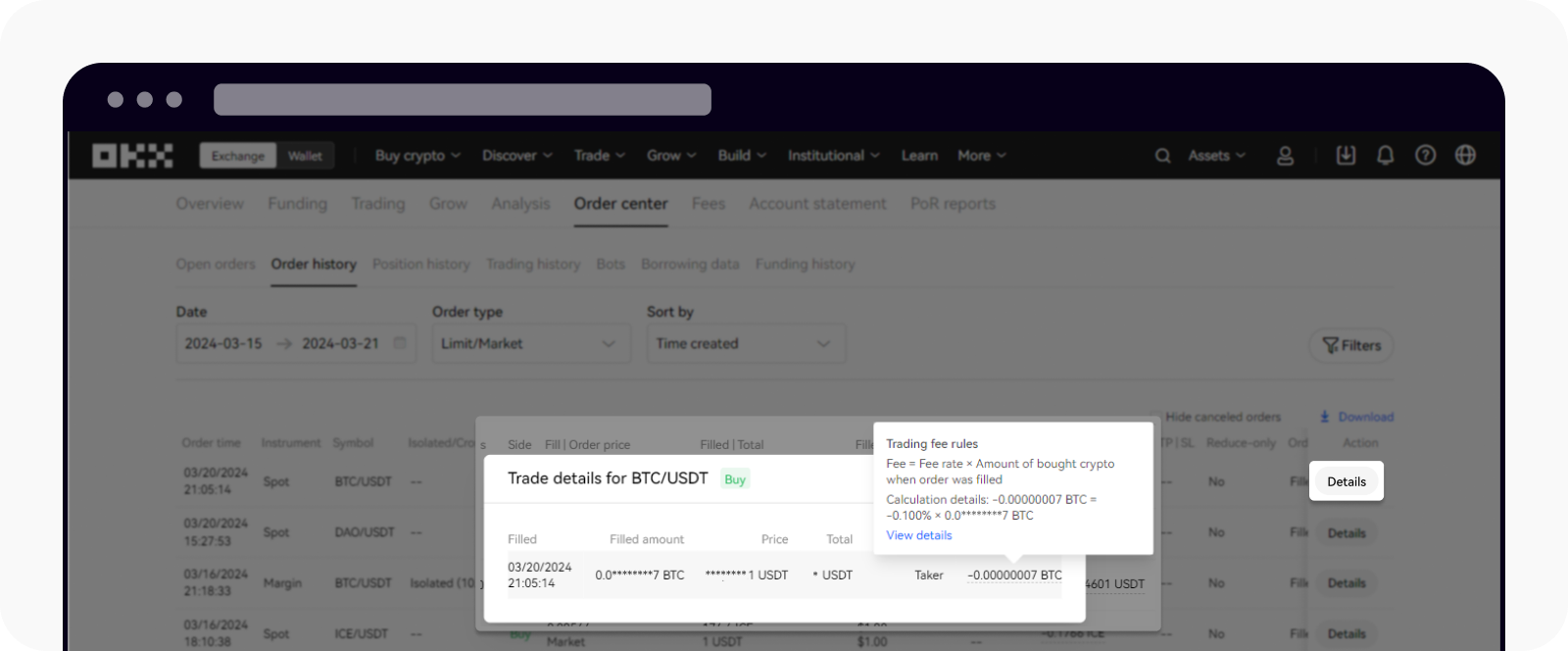

Přejděte do Objednávkové centrum a vyberte Historie objednávek. Zobrazí se výše uplatněného poplatku.

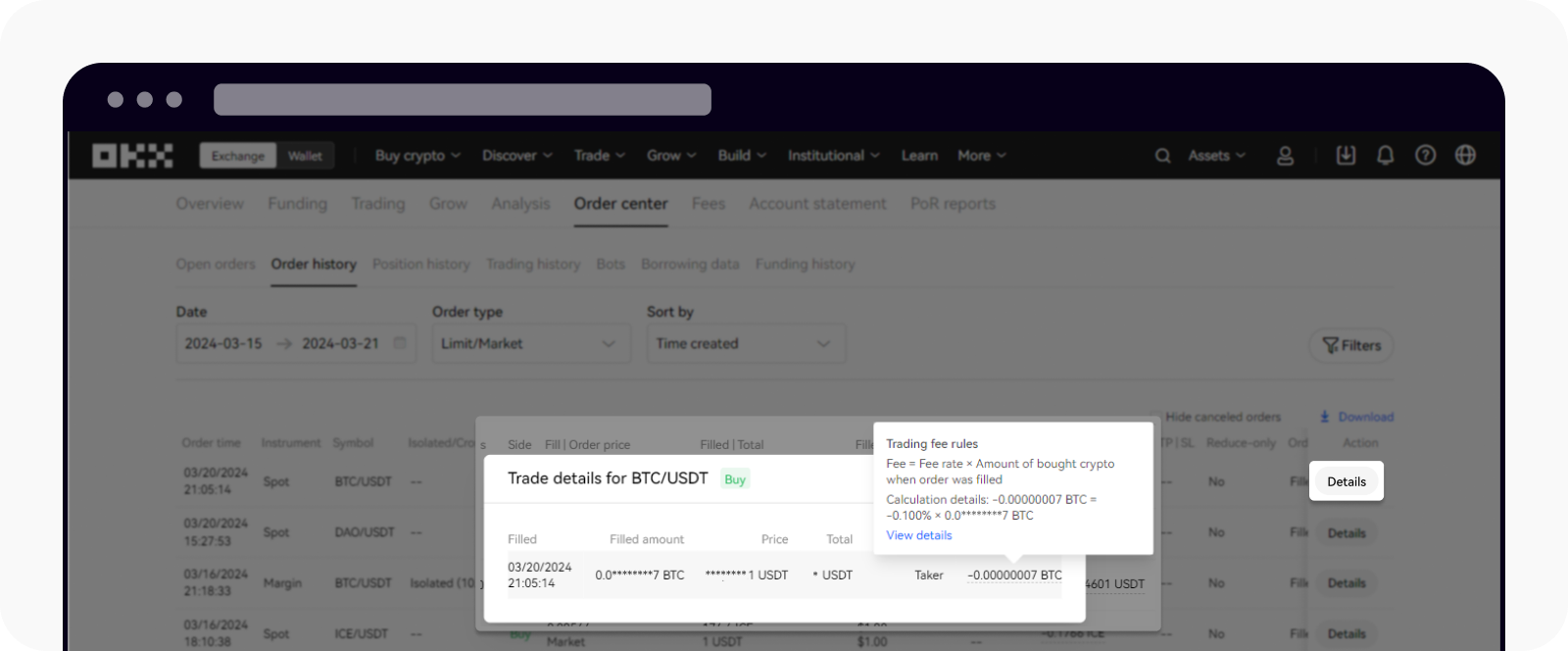

Otevřete stránku Objednávkové centrum

Pokud se chcete podívat na způsob výpočtu poplatku, můžete vybrat Podrobnosti a najet myší na Poplatek.

Vyberte podrobnosti a zjistíte, jak byl poplatek vypočten

Poplatky za své minulé objednávky můžete také najít v naší aplikaci, pokud přejdete na Obchodovat, vyberete Moje obchody a vyhledáte možnost Historie objednávek.

Otevřete stránku s historií transakcí

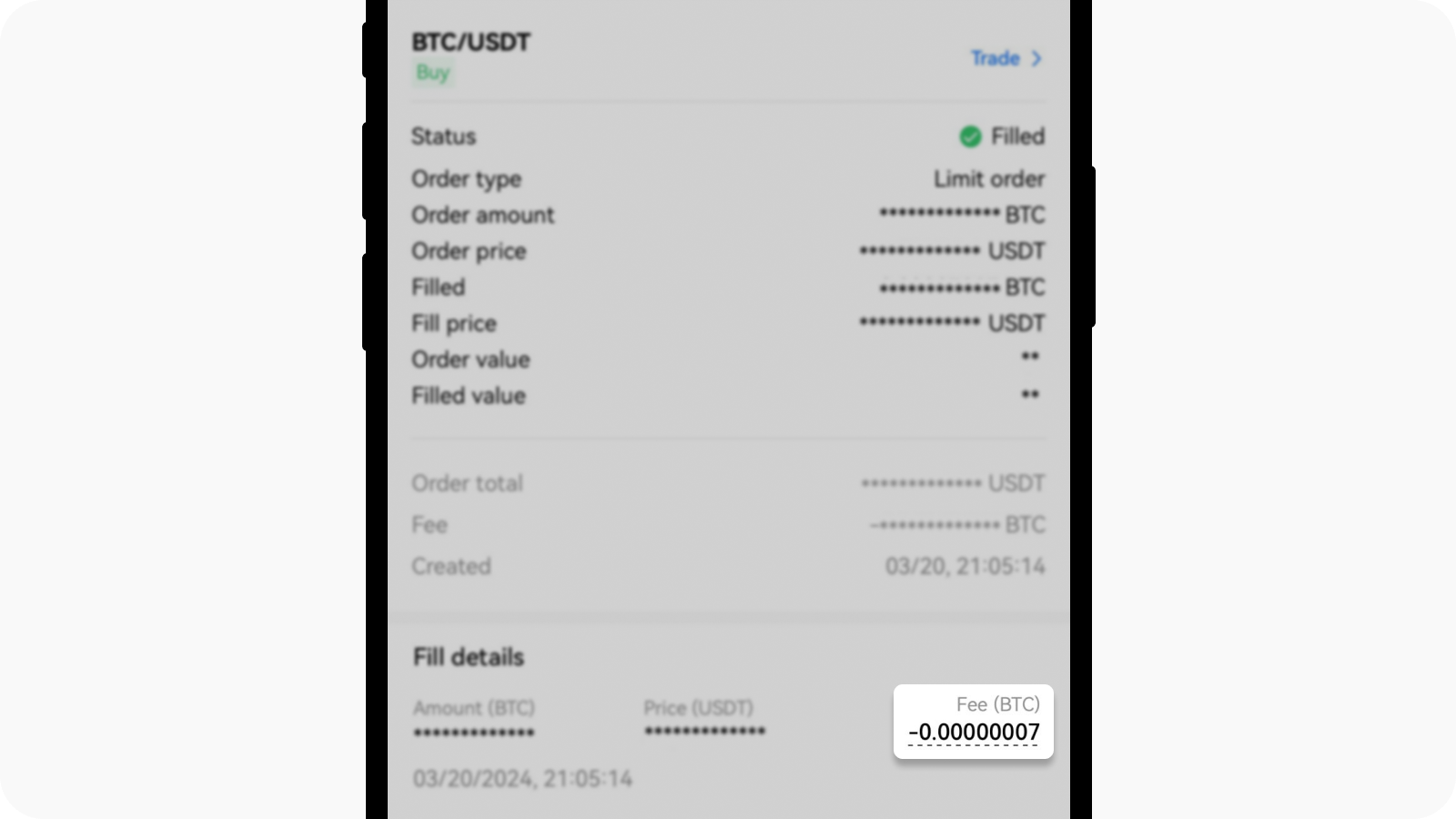

Vyberte historii transakcí, kterou chcete zobrazit, a částku uplatněného poplatku najdete v nabídce Podrobnosti vyřízení.

Zjistěte poplatek, který byl uplatněn u minulé transakce

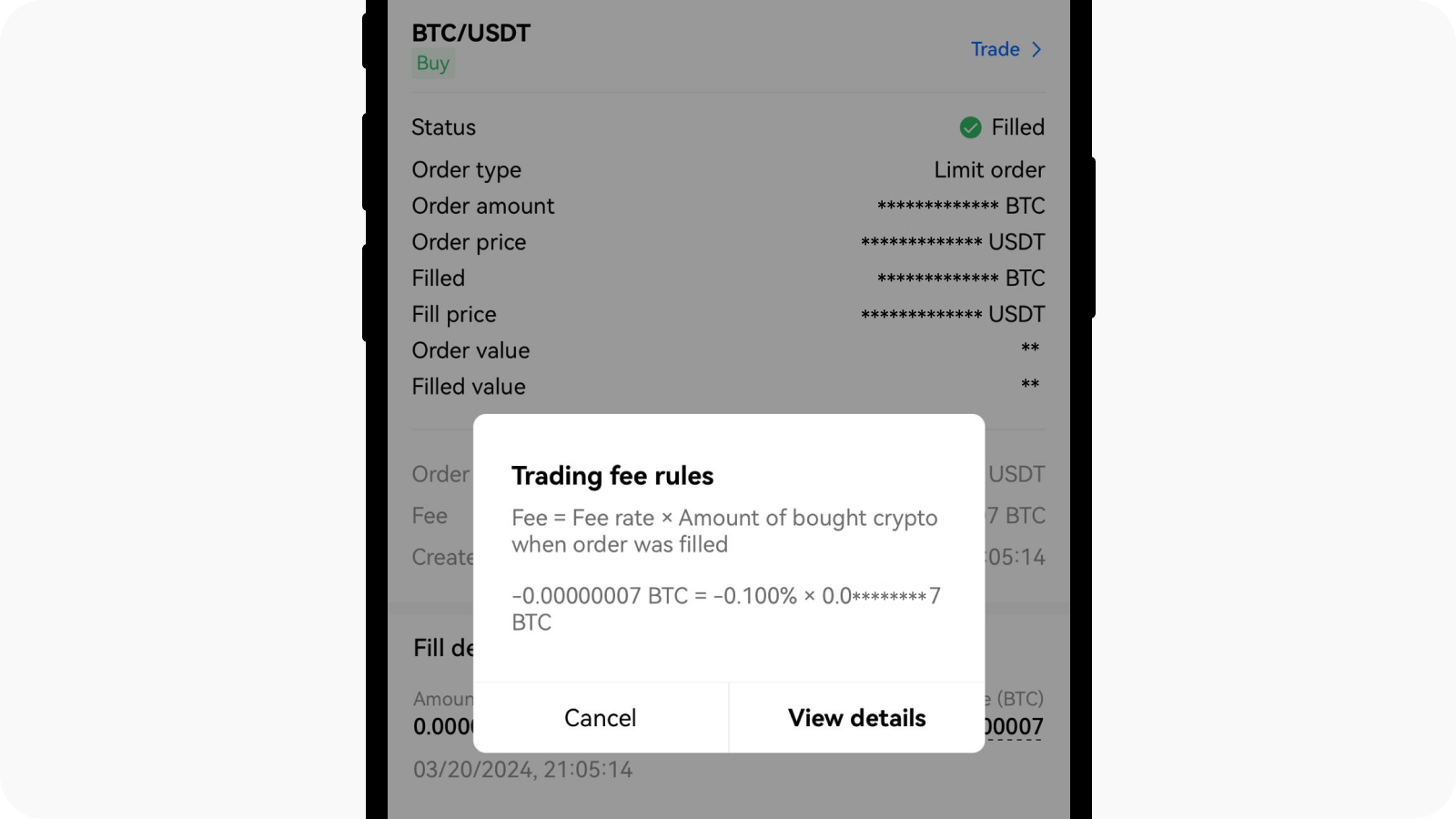

Pokud chcete zjistit, jak se poplatek vypočítává, můžete vybrat výši poplatku a zobrazí se vám podrobnosti o poplatku.

Zobrazení způsobu výpočtu poplatku za obchodování

5. Jak se určuje výše mého poplatku za obchodování?

Výši poplatků můžete zlepšit zvýšením objemu aktiv, objemu obchodů nebo držby OKB.

Na základě objemu obchodů jsou uživatelé rozděleni do běžných a VIP úrovní. Běžní uživatelé jsou klasifikováni podle výše držby OKB, zatímco VIP uživatelé jsou klasifikováni podle výše aktiv a objemu obchodování za posledních 30 dní. Různé úrovně určují poplatky za obchodování pro následující obchodní den.

Při výpočtu výše poplatku, pokud váš objem spotových obchodů, celkový objem perpetuálních a expiry futures (USDT perpetuální futures, USDT expiry futures, USDC perpetuální futures, USDC expiry futures, perpetuální futures obchodované na marži pomocí kryptoměn a expiry futures obchodované na marži pomocí kryptoměn), objem opčních obchodů, objem spreadových obchodů a výše aktiv splňují podmínky pro různé výše poplatků, budete využívat nejvyšší úroveň výhod u poplatků, tj. nejvýhodnější sazbu poplatků.

Pokud například objem spotových obchodů uživatele za posledních 30 dní činí 10 000 000 USD (splňuje úroveň VIP 2), celkový objem obchodů s perpetuálními a expiry futures za posledních 30 dní činí 200 000 000 USD (splňuje úroveň VIP 3), objem opčních obchodů za posledních 30 dní činí 5 000 000 USD (splňuje úroveň VIP 1), objem spreadových obchodů za posledních 30 dní činí 150 000 000 USD (splňuje úroveň VIP 2) a výše aktiv je 5 000 000 USD (splňuje úroveň VIP 4), pak uživatel využívá úroveň poplatku VIP 4 a všechny obchody napříč instrument mohou využívat výhody v podobě poplatků úrovně VIP 4.

6. Jak se vypočítá poplatek za obchodování?

instrumenty | Vzorce pro výpočet poplatků za obchodování |

Spot/marže | Poplatek za obchodování pro spotové/maržové obchodování = výše poplatku × množství zakoupené kryptoměny při vyřízení objednávky. Pravidlo poplatků pro kryptoměny: Poplatek = výše poplatku × částka koupeného krypta při vyřízení objednávky; Pro příklad si uvedeme příklad spotový obchod BTC/USDT za předpokladu, že aktuální cena BTC je 20 000 USDT; Obchodník A (poplatek pro makery: 0,08 %; poplatek pro takery: 0,1 %) koupil 1 BTC za tržní cenu a stal se takerem tohoto obchodu, takže poplatek za obchodování = 0,1 % × 1 = 0,001 BTC a obchodník A obdrží po odečtení poplatku 0,999 BTC; Obchodník A prodal 1 BTC za limitní cenu a obdržel 20 000 USDT. Obchodník A se stal makerem tohoto obchodu, takže poplatek za obchodování = 0,08 % × 20 000 = 16 USDT a obchodník A po odečtení poplatku obdrží 19 984 USDT. Pravidlo o slevě z poplatku za obchodování: Poplatek = výše poplatku × částka prodaného krypta při vyřízení objednávky; Pro příklad si uvedeme příklad spotový obchod BTC/USDT za předpokladu, že aktuální cena BTC je 20 000 USDT; Obchodník A (poplatek pro makery: - 0,002 %; poplatek pro takery: 0,025 %) prodal 1 BTC za limitní cenu a stal se makerem tohoto obchodu, takže poplatek za obchodování vrácený obchodníkovi A = 0,002 % × 1 = 0,00002 BTC; Obchodník A nakoupil 1 BTC prostřednictvím limitní objednávky a přijal 20 000 USDT. Obchodník A se stal makerem tohoto obchodu, takže poplatek za obchodování vrácený obchodníkovi A = 0,002 % × 1 × 20 000 = 0,4 USDT; |

Futures | Poplatek za obchodování na marži pomocí USDT a USDC pro perpetuální a expiry futures = sazba poplatku × (počet kontraktů × násobitel × velikost kontraktu × cena při splnění příkazu). Pravidlo pro účtování poplatků: Poplatek za obchodování perpetuálních futures na marži pomocí USDT se vypořádává v USDT a účtuje se při vyřízení objednávky; Pro příklad si uvedeme perpetuální futures BTCUSDT (velikost kontraktu je 0,01 BTC, násobitel je 1) za předpokladu, že aktuální cena BTC je 20 000 USDT; Obchodník A (poplatek pro makery: 0,02 %; poplatek pro takery: 0,05%) koupil/prodal 100 kontraktů (1 BTC) za tržní cenu s 10× finanční pákou a jako marži použil 2 000 USDT (0,1 BTC). Obchodník A se stal takerem tohoto obchodu, takže poplatek za obchodování = 0,05 % × (100 × 1 × 0,01 × 20 000) = 10 USDT; Obchodník A koupil/prodal 100 kontraktů (1 BTC) za limitní cenu s 10× finanční pákou a jako marži použil 2 000 USDT (0,1 BTC). Obchodník A se stal makerem tohoto obchodu, takže poplatek za obchodování = 0,02 % × (100 × 1 × 0,01 × 20 000) = 4 USDT. Poplatek za obchodování perpetuálních a expiry futures obchodovaných na marži pomocí kryptoměn = sazba poplatku × (počet kontraktů × násobitel × nominální hodnota na kontrakt × cena při splnění příkazu). Pravidlo pro účtování poplatků: Poplatek za obchodování perpetuálních a expiry futures obchodovaných na marži pomocí kryptoměn se vypořádává v obchodované kryptoměně a účtuje se při vyřízení objednávky; Pro příklad si uvedeme perpetuální futures BTCUSD (velikost kontraktu je 100 USD, násobitel je 1) za předpokladu, že tržní cena BTC je 20 000. Obchodník A (poplatek pro makery: 0,02 %; poplatek pro takery: 0,05%) koupil/prodal 100 kontraktů (10 000 USD) za tržní cenu s 10× finanční pákou a jako marži použil 0,05 BTC (1 000 USD). Pokud je obchodník A takerem tohoto obchodu, je poplatek za obchodování = 0,05 % × (100 × 1 × 100 / 20 000) = 0,00025 BTC; Obchodník A koupil/prodal 100 kontraktů (10 000 USD) za limitní cenu s ×10× finanční pákou a jako marži použil 0,05 BTC (1 000 USD). Pokud je obchodník A makerem tohoto obchodu, poplatek za obchodování = 0,02 % × (100 × 1 × 100 / 20 000) = 0,0001 BTC. Poplatek za vynucenou likvidaci: Vypočítává se podle poplatku pro takery na aktuální úrovni uživatele. Poplatek za vypořádání expiry: 0,01 % pro všechny uživatele bez ohledu na jejich úroveň. |

Opce | Poplatek za obchodování s opcemi = Min(sazba poplatku × násobitel × velikost kontraktu × počet kontraktů, 12,5 % × opce premium × násobitel × velikost kontraktu × počet kontraktů) Pro příklad si uvedeme opce BTCUSD (násobitel je 0,01, velikost kontraktu je 1 BTC, opční premium je 0,05 BTC). Obchodník A (poplatek pro makery: 0,02 %; poplatek pro takery: 0,03 %) koupil 100 kontraktů call opcí (nominální hodnota je 1 BTC): Pokud je obchodník A při vyřízení objednávky takerem, pak poplatek za obchodování = Min(0,03 % × 0,01 × 1 × 100, 12,5 % × 0,05 × 0,01 × 1 × 100) = 0,0003 BTC; Pokud je obchodník A při vyřízení objednávky makerem, pak poplatek za obchodování = Min(0,02 % × 0,01 × 1 × 100, 12,5 % × 0,05 × 0,01 × 1 × 100) = 0,0002 BTC. Poplatek za uplatnění = Min(0,02 % × násobitel × velikost kontraktu × počet kontraktů, sazba poplatku pro takera daného uživatele × násobitel × velikost kontraktu × počet kontraktů, 12,5 % × hodnota při vypořádání × násobitel × velikost kontraktu × počet kontraktů) Na denní opce se poplatek za uplatnění nevztahuje. Denní opce jsou opce, jejichž platnost nevyprší v pátek. Platí pouze pro uplatněné opce. Nevztahuje se na neuplatněné opce. Poplatek za vynucenou likvidaci = Min(sazba poplatku pro takera daného uživatele × násobitel × velikost kontraktu × počet kontraktů, 12,5 % × referenční cena × násobitel × velikost kontraktu × počet kontraktů) Na kombinované obchody s opcemi na RFQ je možné využít až 50% slevu na poplatcích! Pro každé podkladové aktivum jsou poplatky za obchodování účtovány za legy podle strany (nákup nebo prodej) s vyšší nominální hodnotou. Do 30denního objemu obchodů s příslušným instrumentem se započítávají pouze legy, za které je účtován poplatek za obchodování. |

Spready | Sazba poplatku za každý instrument je o 50 % nižší než jeho klasická sazba v objednávkové knize, jak je uvedeno v úrovni poplatku. |

Pro další podrobnosti prosím navštivte: https://www.okx.com/fees

7. Jaký je rozdíl mezi poplatky za otevření a uzavření pozice futures?

Poplatky jsou účtovány při provedení objednávky. Mezi poplatky za otevření a uzavření pozice není žádný rozdíl. Poplatky se vybírají na základě velikosti provedené objednávky a odpovídají poplatku pro takery nebo makery.

8. Jsou za likvidaci účtovány nějaké poplatky?

Poplatky za vynucenou likvidaci jsou účtovány podle sazby poplatků pro takery a makery vaší aktuální úrovně.

9. Proč je rozdíl mezi ziskem při držení pozice a po jejím uzavření?

U obchodování s futures a opcemi je realizovaný zisk po uzavření pozice čistý zisk po odečtení poplatků za obchodování a financování. Rozdíl mezi ziskem při držení a po uzavření pozice je způsoben těmito poplatky za obchodování a financování.

Pokud je například hodnota vaší aktuální pozice v perpetuálním kontraktu BTCUSDT 20 000 USDT s plovoucím ziskem 15 USDT, je poplatek za otevření obchodu −4 USDT, poplatek za uzavření obchodu −5 USDT a poplatek za financování −1 USDT. Po uzavření pozice bude váš realizovaný zisk 5 USDT (= 15 USDT − 4 USDT − 5 USDT − 1 USDT).

Při maržovém obchodování se zaznamenává pouze zisk při uzavření, bez realizovaného zisku, takže zisk při držení pozice a po jejím uzavření zůstává stejný.

10. Proč zisky z minulých objednávek a minulých pozic neodpovídají?

V případě obchodování s futures a opcemi obsahují realizované zisky v minulých pozicích zisky při uzavření, poplatky za financování a poplatky za obchodování, zatímco zisky z minulých objednávek obsahují pouze zisky při uzavření. Například po uzavření následující pozice:

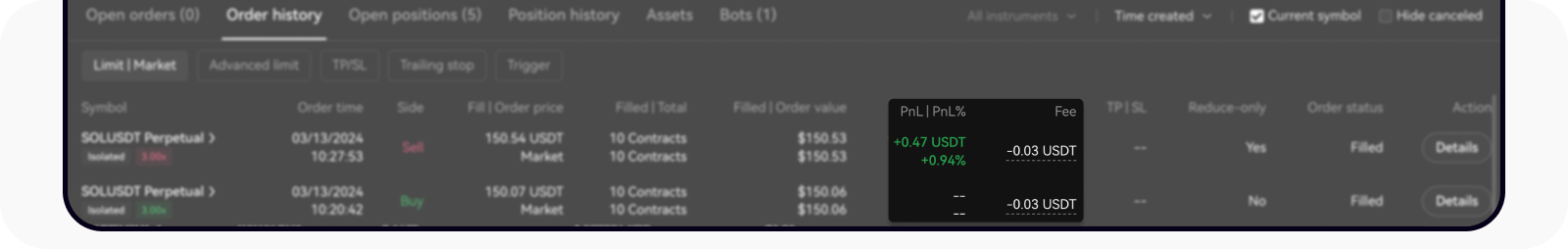

Ze seznamu minulých objednávek vyplývá, že poplatky za obchodování otevřené i uzavřené pozice jsou −0,03 USDT a zisk při uzavření je +0,46 USDT.

Výši poplatků za obchodování vyhledáte v historii objednávek

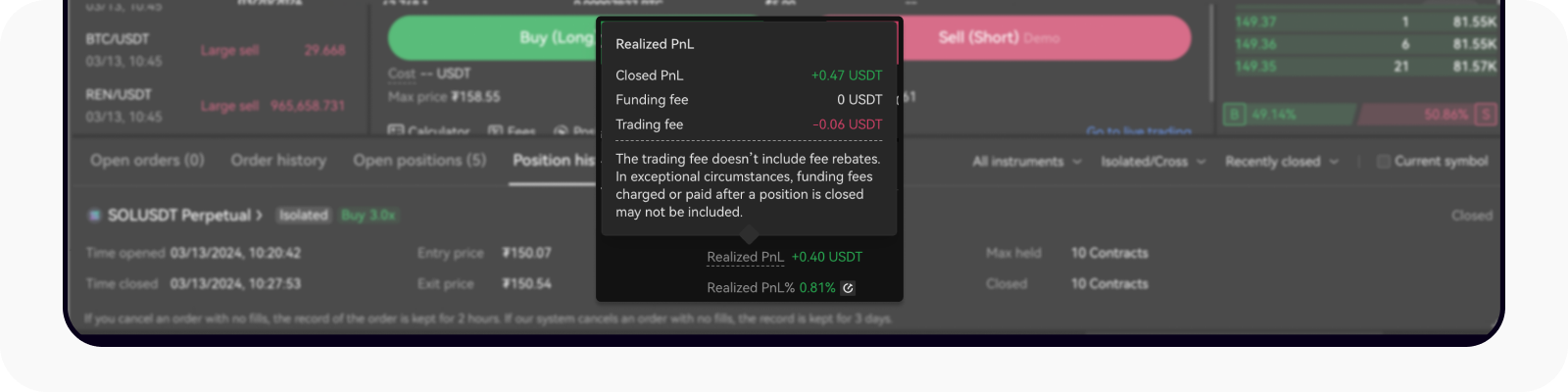

Ze seznamu minulých pozic vyplývá, že realizovaný zisk této pozice obsahuje zisk při uzavření +0,46 USDT. Poplatek za financování je 0 a poplatek za obchodování je −0,06 USDT (= poplatek za obchodování při otevření + poplatek za obchodování při uzavření), takže celkový realizovaný zisk je +0,40 USDT (= zisk při uzavření + poplatek za financování + poplatek za obchodování).

Podrobnosti o realizovaném PnL zjistíte, když najedete na PnL%

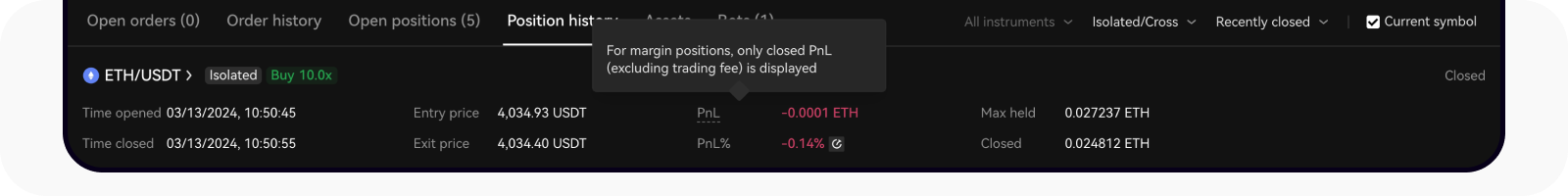

Pro maržové obchodování se zaznamenává pouze PnL při uzavření, bez realizovaného zisku, proto jsou zisky v minulých objednávkách a minulých pozicích stejné.

Vysvětlení PnL pro maržové obchodování najdete, když v historii pozic najedete na pole PnL