如何使用全仓和逐仓模式进行交易?

发布于 2024年6月27日更新于 2025年1月15日阅读时长 2 分钟21

什么是全仓模式?

全仓模式下,同一保证金资产下的所有仓位共用保证金余额。若触发强制平仓,最大损失仅限于该资产下的所有保证金及仓位价值。全仓模式交易具有以下几个优势:

共用保证金:保证金灵活分配,降低市场波动下的平仓风险。

资金利用效率:合并保证金,提高资金利用率,减少追加保证金需求。

风险分散:一个仓位的损失可被其他仓位盈利抵消,有效分散风险。

如何使用全仓保证金模式进行交易?

打开 App 进入【交易】页面,在进行合约交易时,选择【全仓】模式

调整杠杆倍数,设置保证金

审查订单并确认执行

什么是逐仓模式?

逐仓模式下,每个仓位的保证金独立计算,强制平仓时,最大损失仅限于该仓位的保证金。逐仓模式交易的优势包括:

风险控制:损失仅限于该逐仓仓位,不会影响其他交易。

仓位控制:交易者可以更好地控制个人仓位,实现独立管理。

自定义保证金配置:交易者可以根据自己的风险承受能力,将特定的保证金金额配置到不同的仓位。

如何使用逐仓保证金模式进行交易?

打开 App 进入【交易】页面,在进行合约交易时,选择【逐仓】模式

调整杠杆倍数,设置保证金

审查订单并确认执行

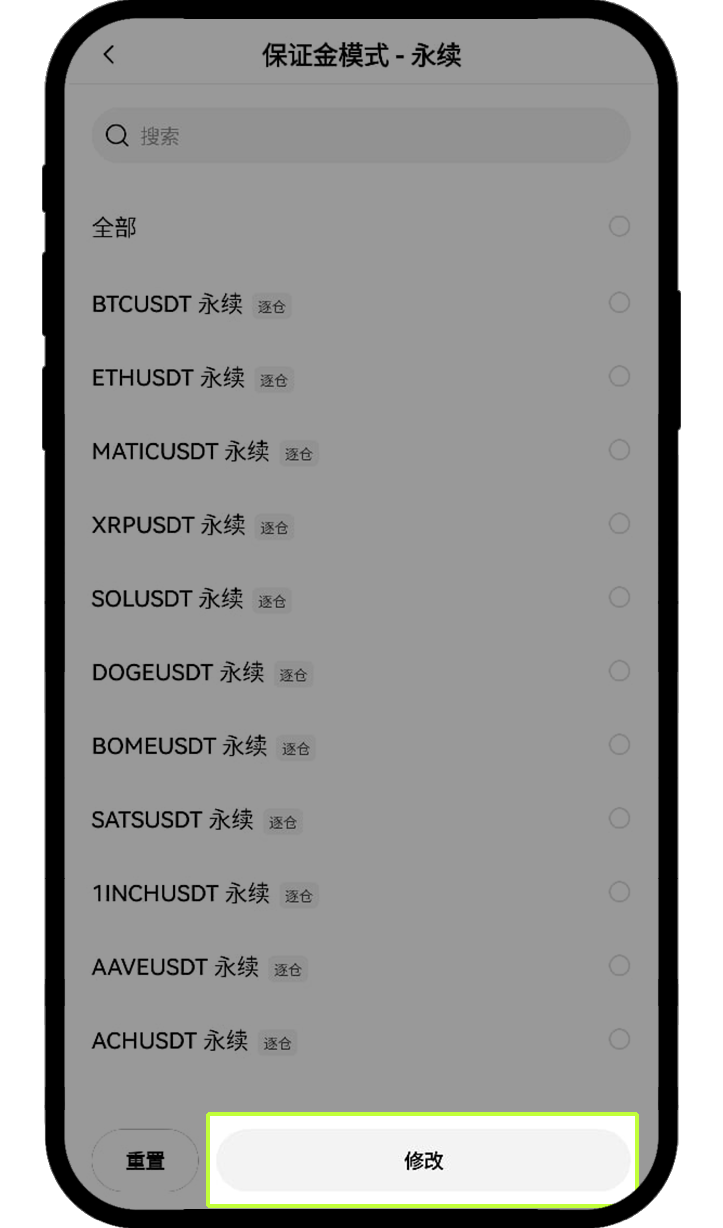

如何在多个资产之间配置保证金模式设置?

如果您希望一次性配置多个资产的保证金模式,无需逐一调整,可通过以下方式简化操作:

在保证金模式菜单中点选【保证金模式管理】,然后选择您想要配置的资产

全仓和逐仓模式各有千秋,交易者可根据风险偏好和交易目标进行选择。无论选择哪种模式,高效的保证金交易都需要周密的计划、持续的监控和有效的风险管理。